Whether you are thinking of moving to Spain or already living here, tax is a major part of your financial life that needs to be considered and planned for carefully.

Tax tips for living in Spain 2023

By Barry Davys

This article is published on: 3rd April 2023

1. In the UK, probably the best savings vehicle is an Individual Savings Account (ISA). This is because the income and capital growth is free of income tax and capital gains tax. It is, however, a UK tax scheme and is not recognised in Spain. Selling your ISA whilst you are still a UK tax resident can save you paying tax in Spain both on an ongoing basis and when you sell. There are also options where you can replace the ISA investments with very similar ones in Spain in a tax efficient manner once you have sold your ISA.

2. If you can, take your 25% tax free lump sum from your pension before you come to Spain. Again this is a UK based tax rule and it does not exist in Spain. You may be able to take part of a pension without tax in Spain, but there are rules and conditions. In the UK it is a clear rule and we recommend taking advantage of it. Like the ISA it is possible to reinvest the money with similar investments as you had in your pension on arrival in Spain.

3. You can pay into a UK private pension for up to five years on leaving the UK and continue to receive tax relief on the contributions. You will need to start the pension before you leave the UK. The limit is a maximum of £3,600 per annum but you only pay £2,880. The government will pay your pension company the difference to make it up to £3,600. A husband and wife paying into a pension for five years would qualify for a UK Government “top up” of £7,200. At the end of five years they would have a pension pot of £36,000 which will remain free of income tax and capital gains tax in Spain, until you start taking money from the pot.

4. Do you need to top up your National Insurance Contributions to improve your UK state pension? It is easier to do this before you leave the UK.

5. The sale of a main residence in the UK is free of capital gains tax. In Spain, the rules are different and you may have to pay capital gains tax on the change in value between the purchase price and the selling price of your home. As an example, a £200,000 gain (not at all uncommon if you have had your house for 10 years) could mean a tax bill of £44,800.

6. If you and your family are considering inheritance tax planning, consider making or receiving gifts before you leave the UK. These gifts can be potentially exempt from UK inheritance tax. In Spain, they would be subject to gift tax.

Once you are living in Spain

7. Are you eligible for the “Beckham Law”? This is a law that was introduced to encourage skilled workers to Spain. The tax rate is set at just 24% for your employment income for a period of five complete Spanish tax years. This is the part of the scheme that you will see most heavily promoted.

However, the scheme also allows you to receive capital gains and investment income from outside of Spain without paying Spanish tax. Careful structuring of your affairs can lead to a plethora of planning opportunities. Perhaps the biggest opportunity is selling your UK business and paying 0% tax on the sale. For further information please email barry.davys@spectrum-ifa.com

8. If you are approaching retirement or retiring to Spain, it is possible to save tax on the income you receive by planning the source of your income. As a brief example, pension income is generally taxed as employment income and taxed at your highest rate. Drawing funds from an investment can result in tax as little as 2%. From another source there can be 0% tax. To benefit from this planning it is important to have an adviser who understands your situation and requirements at the same time as having a clear understanding of how investments are taxed in Spain.

9. Different investments attract different tax treatments in Spain in the same way as they do in other countries. There are investments in Spain that are taxed more than others. Try to use the lower tax ones where the investment matches your requirements. You can benefit from many years without paying income tax and capital gains tax.

10. In Spain, inheritance tax is based on taxing the person receiving the inheritance rather than taxing the estate of the person who has died. If inheritance tax is a concern, with the right advice you can build a plan which manages the amount of tax due. The bedrock of the plan should be that you are not left short of money in later life. Your plan should then match your personal requirements. Some planning is simple and straightforward, so it is worthwhile looking at inheritance planning before events overtake you.

11. Are you considering returning to the UK? It is also worthwhile thinking about the possibility of an unplanned return to the UK if one partner were to die, for ill health or ill health of a family member in the UK such as a parent. If a return to the UK is a possibility, make sure you have the type of investment which will not tax you in the UK for the time you have spent in Spain.

The banking industry

By Jeremy Ferguson

This article is published on: 28th March 2023

What is wrong with the way some banks work nowadays? It seems to me you can run a poor show, and when things go badly wrong the central banks will bail you out, and then off you and your highly paid colleagues can go again to mismanage your way to the next catastrophe.

The one thing I explain to people time and time again is that when you deposit any of your hard- earned cash in a bank, the bank has it is on ‘their’ balance sheets. They can then use that to go off and lend money or invest in assets where they can make more money. So effectively, they are using your money to make themselves money. The problem is that a lot of what they do may need a long timeline to work, so if people start demanding their money in large numbers (known as a run on the bank), they may not actually be able to meet those requirements, hence they close the doors to withdrawals.

Years ago a run on a bank would take time, with people literally queuing around the block looking to withdraw their money from the person behind the counter. The trouble nowadays is that a run on the bank is so much easier to implement, with all of us having apps on our phones and laptops that mean we can ask for our money in an instant. That was one of the biggest issues contributing to the failure of Silicon Valley Bank in America a couple of weeks ago, and the start of this whole process of fear beginning again. Due to the frenzy of concerns about that bank being whipped up on social media, thousands of clients started to try and withdraw their deposits all at the same time. To say the run on the bank happened quickly would be an understatement.

It is interesting to see what happened by looking more closely at what went wrong there. The bank had a huge amount of funds on deposit, and although they were large lenders, they had a lot of excess cash doing nothing for them. They needed that to be making money for them so, in their view wisely, they bought a large amount of 10 year government bonds. They did this because government bonds are traditionally seen as safe and would earn a small return.

Then the Fed started raising interest rates in a bid to stem inflation. Of course, this then meant the value of the government bonds became more and more stressed the higher the rates went. Effectively the clients’ money was now in the wrong place and couldn’t easily be unwound. In simple terms, a pretty basic error which you would hope someone looking after your money should have been aware of.

As I write, the contagion this whole issue has caused in the banks is causing share prices to tumble again. It’s so frustrating when this sort of thing happens, as very often it’s the baby being thrown out with the bathwater, but unfortunately this is how the stock markets tend to be. Anyway, it never seems to change and the fact that the Fed raising interest rates has led to the banks ´´crumbling´´ is somewhat bizarre in my humble opinion, when they seem to think they know what they are doing!

I speak a great deal with clients about using ‘insurance’ based products to house their investments. The reasons and advantages are many but the most relevant point I like to make, and relevant to what I’ve been talking about, is when you invest your money in these companies it is physically off their balance sheet and held for your benefit only. That’s the polar opposite to leaving your money in the bank. Of course, the risk is then what you do with your money, but it’s a massive point that is regularly overlooked and gives people a high level of comfort.

If you are worried about your money and where it is at the moment please feel free to get in touch and we can see what alternative solutions may be available for you.

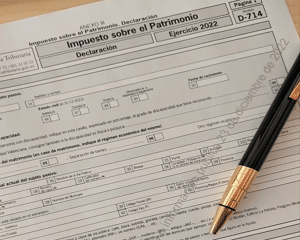

Am I paying too much Wealth Tax in Spain?

By John Hayward

This article is published on: 21st February 2023

Just when you thought that it was safe to win the lottery in Andalusia or Madrid, the socialist Spanish government have introduced a new

temporary Solidarity Tax.

According to Investopedia, a solidarity tax is a government-imposed tax that is levied in an attempt to provide funding towards theoretically unifying (or solidifying) projects. In other words, it is a tax on the wealthy to provide funds for the not so wealthy. Other regions still have Wealth Tax with varying allowances and this will continue without the risk of having to pay two taxes. That said, taxes are rarely straightforward and I am confident that there will be issues in the future which will result in the Spanish tax office tweaking things. It is interesting, if not extremely concerning, that Wealth Tax was introduced on a temporary basis as well. It has been around for the last 11 years. So, not really temporary in my opinion.

We are in Modelo 720 season at the time of writing, with overseas assets having to be declared by 31st March. Although not a tax declaration, the Modelo 720 naturally leads on to Wealth Tax. One of the asset types to declare is property.

In Spain, the tax office can reference the Cadastre to establish a property value. However, they do not have access to the land registry in, say, the UK. Therefore, the only price that is in writing is the purchase price. It is this value that should be entered on the Modelo 720 and subsequently be liable, or not, for Wealth Tax. My suspicion is that people have declared what they believe to be the market value and are possibly paying too much in Wealth Tax as a consequence.

By redistributing wealth and utilising the allowances, and applying the 60% rule (contact me for more information), it is possible to reduce Wealth Tax (and/or Solidarity Tax) or even eliminate it completely.

We can introduce you to investment products that are not only tax efficient in Spain in terms of income tax but can help to reduce Wealth Tax.

Saving for retirement in Spain

By Chris Burke

This article is published on: 8th February 2023

Retirement options

One of the big differences when you move to Spain are the options available to you for retirement planning. In the UK/Ireland we have ISAs and private/employer pension schemes which both offer good tax savings.

ISAs are not tax free in Spain, and the annual ‘private pension allowance’ is only €1,500 per year per person! In some employer contribution schemes you can save up to €10,000 per year, but these are very uncommon. Compare that to £40,000 per year in the UK, or in Ireland up to €115,000 per person, per year! €1,500 per year is never going to achieve any serious amount of income for retirement.

The main reason for this is that in Spain, culturally people preferred to set up a company structure or accrue properties, passing these from generation to generation. Additionally, there is a lack of incentives from the authorities to entice people to save into retirement schemes.

Pensions have been popular for retirement in the UK/Ireland because of the tax savings and potential employer contributions. Take both of those away and they are not nearly as effective, which is what happens when you move to Spain. So, what can you do if you want to plan for retirement in a tax efficient manner?

For me, retirement is not just about a pension, it’s about a retirement plan. We help clients build that retirement strategy, taking into consideration the amount of income they want, making sure their assets are highly tax efficient (such as moving them away from future income tax positions) and then making sure everything is flexible and portable, because you never know what will happen in life. This is all done by using our client planning portal, where we work together to bring this to life using the following process:

This is all done by planning, where we work together to bring this to life using the following process:

- Assess existing assets including ISAs, pensions and other savings/investments

- Understand your objectives and when/where you are looking to retire and with how much

- Understand your current and ongoing financial situation, taking into account future events such as children/grandparents

- Compile this into a strategy where we plan, implement and review

- Review and adapt as the years go by evolving the plan to fit your life

We never know exactly what’s going to happen, but one thing is for sure, with proper informed planning and regular analysis, you will be much better prepared.

Am I tax resident in Spain?

By Barry Davys

This article is published on: 24th January 2023

Case Study Spanish Tax Resident Couple

Husband 60, wife 60, married, with 2 children who are financially independent and living in the UK

👉 Pensions: £930k

👉 Investments £60k

👉 Cash Spain €60k

👉 House €1.25 M

👉 Wills – UK & Spain

👉 Cash UK £184k

Challenges

Build Understanding of Pension Situation

- Pensions will break UK Lifetime Allowance Rule even as Spanish Resident

- Difficulty estimating pension as coming from four different pension schemes

- When can I retire

- No overall investment strategy for pensions

- How to minimize tax on pensions

Better returns on Non Pension monies

- Bank accounts earning only 0.15%

Forward Planning including Inheritance tax

- Would Mrs X have enough to maintain property if current pensions provided only 50% pension on husband’s death?

- What would be the Spanish Inheritance tax if one partner died?

- How would this Inheritance tax be paid?

- How is inheritance tax applied in Spain and UK?

- How can the UK and Spanish inheritance tax liability be managed?

What we did

- Completed a full financial review of present financial standing

- Undertook a cash flow forecast to establish if widow’s pension was sufficient, how to pay inheritance tax on first death and how long their money will last

- Provided a Transfer Value Analysis report by our qualified pension expert – a Fellow of the Chartered Insurance Institute

- As a pension was a defined benefit pension, a secondary full report provided by a FCA regulated adviser with full UK pensions permissions in line with UK, FCA rules

- Consolidated pensions to improve tax efficiency, improve widow’s pension and manage in line with their other assets

- Built investment strategy to improve return on their investments and cash

- Clarified how inheritance tax works in Spain and UK and gave an estimate of tax due

- Built an inheritance tax strategy, including sufficient money available to pay tax in Spain on first death

- Minimised Spanish Tax paperwork and liaised with Spanish Tax adviser

- Produced Family inheritance tax strategy document so whole family knew the strategy without disclosing amounts held by the parents

- Wrote to UK HMRC for confirmation that the family home in Spain will qualify for the Main Residence Nil Rate Band

- Identified a UK inheritance Tax saving on a UK life assurance policy

- Carried out regular reviews over 6 years (so far) to update investment and inheritance tax strategies and to adapt to changes to the law

The RESULTS

✅ Clarity for clients and children on Inheritance Tax

✅ Improved return on bank accounts to 3.5% pa giving an improvement of 4,200 pa

✅ Removed pensions from UK Lifetime Allowance rules

✅ By providing documentary evidence from UK HMRC for Main Residence Nil Rate Band confirmed an inheritance tax saving of up to £140,000

✅ Improved widows pension by £7,000 pa

✅ Kept clients compliant with changing tax rules

✅ Answered the financial question “Am I going to be OK?” with a “Yes”

If you are a resident in Spain, or are planning to become a resident and would like any information on tax, pension transfers, investment planning or general financial planning you can contact me on:

barry.davys@spectrum-ifa.com or direct on 0034 645 257 525

More Spanish residents to pay wealth tax

By John Hayward

This article is published on: 19th January 2023

Valencia reduces allowance with more people having to pay

the Impuesto Sobre el Patrimonio

Further to my article from last week, and after consultation with our accountant associates, it appears that the main residence wealth tax allowance of up to €300,000 only applies after 3 years of living in the property (habitual residence). This has been questioned but, as is often the case in Spain, getting a response from the tax office can be tricky.

The tax office words that are relevant in terms of getting around this 3-year rule are “circumstances that necessarily require the change of housing”. Moving to Spain to retire or for a change of lifestyle would not generally tick that box. If there are justifiable health reasons or similar then that appears to be acceptable in terms of applying the allowance.

To emphasise the habitual residence aspect, from JC & A Abogados in Marbella: “Please note that you must live effectively and consecutively in the property for more than 3 years, so you cannot rent the house out even for one day. In addition, you have to impute a benefit in kind for the Spanish property during the same 3 years period.”

In the words of JC & A, “The 3 year period starts counting from the purchase date as long as the dwelling is inhabited effectively and permanently within 12 months as from the purchase date.”

“…..a taxpayer who bought his main home but could not live in it because it was not suitable and had to have some works that exceeded 12 months; the conclusion is that the 3-year period starts counting from the date he moved in and not the purchase date.”

Adding salt to this potential tax wound, whilst it is not treated as your main residence (even though you live there permanently), you have to pay tax on its value as if you were a non-resident.

This all seems rather inequitable but is the law as things stand.

If you would like to discuss managing your money in these volatile and uncertain times, please do not hesitate to contact.

Visit John Hayward of The Spectrum IFA Group or complete the form below.

What a year this has been. Let’s hope next Year is better..

By Jeremy Ferguson

This article is published on: 22nd December 2022

At the beginning of this year the World started to ‘wobble’, set off by the Invasion of Ukraine, and rising murmurs about the likelihood of increased inflation, and with that the threat of rising interest rates.

Share prices in companies around the world quickly started to fall, shortly followed by the never-ending spiral of doom and gloom in the news, creating a continuously depressing stream of information showing the Worlds financial markets were taking a downturn. This all came as a bit more of a shock because of the unprecedented period of cheap money, and constantly increasing share prices everyone had become used to over the last ten years.

After the lockdowns I always maintained you couldn’t just stop the world turning without it eventually to have some sort of effect. It just took a while for it to come out in the wash – and now it has. A lot of the delay between stopping economies working, (and a noticeable effect), was the false security provided by what amounted to the printing and the subsequent handing out of money in many countries, to name but one of many factors that occurred during those crazy times.

Eventually, after the factories were closed and businesses shut, supply chain issues came to light. The backlog of empty production lines had to be dealt with. That, coupled with an imbalance between limited supply and a sudden surge in demand, rising transport costs, plus the knock-on effect of the War in Ukraine, have all resulted in inflation going through the roof.

Traditionally the central banks around the globe try and control inflation with interest rates, and at the moment they are raising them at one of the fastest rates ever seen in a bid to try and stem the current surge in inflation. The worry for next year will be whether they may slow things too much, as these things tend to have a time lag. We can only wait and see. Higher interest rates are not all bad news, as savers normally benefit from interest on their bank deposits, but this isn’t happening significantly to date. When they are being offered, my experience is that the bank will only allow relatively small amounts to be deposited in these savings accounts offering higher rates.

On top of everything already mentioned, other factors also came to a head this year – the UK started to feel a Brexit effect which has weakened overseas investor confidence and taken its toll on trade. Liz Truss’s infamous UK mini-budget caused UK Government Bonds to fall in value like crazy, and what is usually considered a safe haven for many clients and pension funds, took a drastic downturn.

Recessions normally have an effect on employment, but at the moment this looks ok. Interestingly however, if you look at the US, there are an estimated 4m people off work at the moment due to long covid, so figures there are certainly distorted.

So as you will already have gathered, 2022 really hasn’t been a great year!

Living in Spain is such a privilege for many of us. The doom and gloom out there at the moment seems so much more acceptable when you wake up to beautiful weather almost all of the time. The cost of living has risen, but in general terms Spain is still a lot cheaper to live in than the UK.

They say it’s important to count your blessings, and if the fact we live here is one of them, then I for one am looking forward to 2023.

If you fancy an overview of your finances, even if it’s just to reconfirm your plans are all well founded in light of the ever-changing world, please do not hesitate to get in touch.

Spain’s New Digital Nomad Visa

By John Lansley

This article is published on: 19th December 2022

We are familiar with images of people in deckchairs, equipped with a laptop and a cocktail, brilliant blue sky and sparkling sea in the background, happily working in exotic locations – but how realistic a picture is this here in Spain?

The pandemic has seen huge changes in the way many work, with WFH (working from home, or working remotely) becoming a reality for the lucky millions who were able to do so. The choice of returning to your office or continuing to work from your kitchen table may not always have been yours to make, with employers holding differing views about both supervision and the benefits of having colleagues close at hand.

Whatever the case, for some, WFH continues, perhaps only for a few days a week, but for many their employer doesn’t mind where they are located, as long as the job gets done.

Spain has now joined other countries in offering a specific working visa to those who satisfy the requirements. Since Brexit, many from the UK have seen their dream of moving to Spain shattered by the much tougher visa requirements that now apply. I have written before about the Golden and Non-Lucrative Visas, which favour the wealthy retired, but will this new route provide a real opportunity?

The Digital Nomad Visa is part of new legislation that is designed to encourage business start-ups, to try to improve Spain’s attractiveness to entrepreneurs, and which includes reduced levels of tax for individuals and businesses setting up here.

Let’s look at what we know about the requirements of the new scheme, due to commence in January 2023

- Applications will be open to 3rd country nationals (non-EU countries, including the UK)

- Applicants must work mainly for companies based outside Spain

- Applicants’ work must be exclusively online or by telephone

- Applicants must be graduates or postgraduates from a ‘prestigious recognised university or business school’ or have 3 years’ professional experience

- The applicant must have been working for the same company/ies for at least a year prior to the application

- The company must have approved remote working

- Applicants must demonstrate they can do their job online and that they have been doing so for at least 3 months prior to applying

- The visa will be initially for 1 year, and can be renewed thereafter (renewal should be applied for within 60 days before expiry) for up to 5 years in total

So, in practice, this limits access to the visa to those with good educational qualifications or previous professional experience, and who have already been working remotely.

What don’t we know?

- There will be a minimum income requirement, as yet unknown, but likely to be similar to the €2,316pm currently applying for a Non-Lucrative Visa

- Spanish medical insurance might also be required, to ensure the applicant is not a burden on the Spanish healthcare system

However, those lucky enough to qualify will have to be aware that they will in all likelihood become Spanish tax residents, with potential consequences for their employers, tax deductions and national insurance contributions.

But the new digital nomad visa could be a path for you to take if you are keen to move to sunnier climes, experience international work possibilities – carrying only your professional expertise and your laptop, you could be opening the door on a new life!

Moving to Spain is more complicated than ever before, but this new opportunity may help you do so. Obtaining professional help with visas, tax planning, buying a home and investment possibilities is essential, and my colleagues and I will be happy to help, and introduce you to trusted professional partners where appropriate.

Financial updates in Spain

By Chris Burke

This article is published on: 23rd November 2022

This month we cover the following topics (if there is anything you would like to understand more or wish to see covered in these articles, don’t hesitate to ask):

- Digital Nomad Visa – Update

- New Wealth Tax Implemented for those with assets over €3 million

- New Autonomo payments from 2023

Digital Nomad Visa – Update

The Spanish Government has confirmed plans for its digital nomad visa scheme. The scheme will offer citizens from non-European Union countries the opportunity to live in Spain whilst working remotely for companies located outside the country.

The visas will be available for those who derive a maximum of 20 per cent of their income from Spanish firms and who work remotely for companies located outside Spain. The visas should bring vital help to the Spanish economic sector and that it will also help the country recover from the economic damages caused by the Covid pandemic.

Even though there has been no detailed information publicly and the law has not yet been 100% passed through Parliament, it has been publicised that the visas will be initially granted for a period of one year. There will then be the opportunity for this period to be renewed for more than five years, depending on the circumstance of the applicant.

Spain’s Economic Affairs Minister, Nadia Calviño, stressed that “the digital nomad visa will attract and retain international and national talents by helping remote workers and digital nomads set up in Spain.”

In order to benefit from Spain’s digital nomad visa, applicants must be able to show or prove that they have been working remotely for at least a year and be from outside the European Economic Area. They must also show that they hold a contract of employment or, if freelance, prove that they have been regularly employed by a company outside of Spain. Proof that they have enough money to be self-sufficient and have an address in Spain is needed too.

Spain is not the first country in Europe to instigate a Digital Nomad Visa programme. Estonia, Croatia, Portugal and Iceland already have a similar visa scheme, and in January this year the Government of Romania implemented a similar visa.

New Wealth Tax Implemented for those with assets over €3 million

Spain is set to implement a new wealth tax, its second, as the country looks for ways to raise funding to pay for social policies amid soaring inflation.

As reported by Bloomberg, those who have assets worth at least €3 million ($2.9 million) a year from 2023 will be affected, the Budget Ministry said in late September. Payments made against an existing wealth tax will be deductible from the new one, it said.

There are three ranges to the tax:

| Assets | Tax (Payable Yearly) |

|---|---|

| Between €3 and €5 million | 1.70% payable on the value of the assets |

| Between €5 and €10 million | 2.10% payable on the value of the assets |

| Over €10 million | 3.50% payable on the value of the assets |

23,000 people will be affected by the new tax and is expected to raise around 1.5 billion Euros. In 2024 another 204 million is expected to be raised by an increase of up to 2 percentage points on incomes above 200,000 Euros a year. There will be tax reductions for lower earners which is estimated to be worth about €1.88 billion over two years.

New Autonomo Payments from 2023

Self-employed workers (Autonomo’s) in Spain will start paying new monthly social security fees which will be based on the amount they earn. The changes will be brought into force from January 2023.

For those newly self-employed and under the age of 35:

| Time Period | Amount Payable |

|---|---|

| The first 12 months | €60 (80% reduction) |

| Month 13 – Month 18 | €146.97 (50% reduction) |

| Month 19 – Month 24 | €205.76 (30% reduction) |

This flat rate is a measure to promote self-employment that consists of paying a reduced monthly Social Security contribution as a self-employed person for two years.

For those who have been self-employed for two years or more:

| Amount earned per month (€) | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|

| < 600 | €281,50 | €269,30 | €257,00 | €244,80 |

| 600 – 900 | €281,50 | €269,30 | €257,00 | €244,80 |

| 900 – 1.125,90 | €293,90 | €293,90 | €293,90 | €293,90 |

| 1.25,90 – 1.300 | €351,90 | €351,90 | €351,90 | €351,90 |

| 1.300 – 1.500 | €351,90 | €413,10 | €413,10 | €413,10 |

| 1.500 – 1.700 | €351,90 | €413,10 | €474,30 | €474,30 |

| 1.700 – 1.900 | €351,90 | €413,10 | €474,30 | €535,50 |

| 1.900 – 2.330 | €351,90 | €413,10 | €474,30 | €535,50 |

| 2.330 – 2.760 | €351,90 | €413,10 | €474,30 | €535,50 |

| 2.760 – 3.190 | €351,90 | €413,10 | €474,30 | €535,50 |

| 3.190 – 3.620 | €351,90 | €413,10 | €474,30 | €535,50 |

| 3.620 – 4.050 | €351,90 | €413,10 | €474,30 | €535,50 |

| >4.050 | €351,90 | €413,10 | €474,30 | €535,50 |

*Source: Government of Spain

In summary, the current minimum fixed payment of €294 will be changed to a progressive system of 13 instalments, depending on income. This will be introduced over 9 years. It’s important to note that these changes have not yet been finalised and there are still some details to be agreed.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch. You can book an initial consultation via my calendar link below or email/send me a message.