The Beckham Law – Spain

By Chris Burke

This article is published on: 7th July 2023

Many people are aware of the Beckham Law or soon find out about it (hopefully) when they arrive in Spain. In this article I am not going to explain it’s benefits because most people know these, but I am going to explain how being on this tax regime can potentially CHANGE your whole financial future with proper planning.

The big attraction regarding the Beckham Law for many is the low, one band income tax of 24% up to an income of €600,000 per year. Whilst this can massively increase your income over the 5 complete tax years you are here (if you start the Beckham Law in a January/February you pretty much have 6 years on this regime) and allows you to potentially save/put aside thousands over that period of time, for me the other benefits it offers can have the biggest impact on your financial future.

Your worldwide income is not taxable on the Beckham Law whilst tax resident in Spain, which is great if you have investments/assets outside of Spain which would normally need to be declared and tax paid. So, let me give you an example:

You have investments/pensions outside of Spain (let’s say in the UK for this exercise) that are around £1million in total, split into the following asset classes:

- Investment/ISA portfolio £300,000

- Stocks/shares £300,000

- UK pension £400,000

If you were not on the Beckham Law, each time you took money from these assets you would normally pay capital gains tax up to 28% on investments/Isa/stocks/shares and income tax up to 47% on the pension. Imagine if you could ‘encash’ these assets all-in-one go and do NOT pay any tax. Then moving forward set these up in a highly tax efficient manner. You wouldn’t pay any tax on these amounts ever and minimal tax on any gain they made, as these could be offset/deferred and mitigated. Well, normally (always depending on your situation) on the Beckham Law you can do this. You are not a UK tax resident thus there is no UK tax to pay (as long as you have informed that to HMRC) and as a Spanish resident on the Beckham Law there is also no tax to pay on income outside of Spain.

So, rather than pay up to 28% tax on the investments/gains (approximately £138,000 in the above example) and income tax of approximately 30% on the pension income (considering the pension income alongside your state pension also) gives a tax saving of approximately £6,000 per year… for life. Over 30 years that’s £180,000 plus inflation. You have also, very importantly, turned the pension (which has to adhere to pension laws) into a lump sum of money free of tax and are able to do with this what you wish.

Once you have ‘encashed’ these assets and paid zero tax ´potentially´, you can then plan for when the Beckham Law ends, particularly because these are highly tax efficient and minimal taxes would need to be paid on in the future.

This is just one way that smart, efficient financial planning can massively change your financial future that we implement for clients on a daily basis. Alongside this we work with successful, well known mainly UK known investment companies, including ethical and sustainable investing, to work on greatly increasing and secure our clients financial future.

One last note, UK property can also work this way, however savings tax is still payable in the UK on this as a non-UK resident, although there are some potential allowances.

Click here to read independent reviews on Chris and his advice.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with Chris.

You can book a call or Zoom meeting with Chris below.

Reducing Spanish tax

By John Hayward

This article is published on: 27th June 2023

Use a beneficial savings structure

Investing money is often seen as a risky thing to do even though it is generally understood to be necessary. For example, those receiving pension income would not be in the same position if the companies paying the income had left all of the pension contributions in a current account or in a box under the bed.

Financial markets can be volatile (always, I hear you shout). We fully appreciate this. We also acknowledge that inflation has created higher interest rates. Better news if you are a saver but not so pleasant for mortgage payers, or parents having to help their children pay off increased debt.

Let us imagine that, for the foreseeable future, we have high inflation accompanied by higher interest rates. Using an amount of £500,000, I have compared depositing in a savings account with investing in a Spanish compliant investment bond and I have used an interest/growth rate of 4%. I have based my comparison on the bond paying growth to the bondholder’s bank account and using GBP as I cannot see any Euro accounts paying 4%.

– £500,000 at 4% = £20,000

– Using an exchange rate of 1.16 £/€,

– £20,000 = €23,200

The deposit account interest is taxed in full and, at current 2023 rates, is €4,752 each year. This has to be declared in the annual tax return.

The Spanish compliant bond attracts tax on the gain within the withdrawal. I have based the calculation on the same amount being withdrawn i.e., €23,200. In the first year, the taxable gain within this is only €892 and the corresponding tax is €170. The taxable amount within the bond income increases over time but, over 10 years, the tax is:

– €47,520* on the deposit account interest

– €8,381* on the bond income

This gives a tax saving of over €39,000 over 10 years by using the Spanish compliant bond.

If no money is withdrawn from the bond, no tax is payable whereas the interest on the deposit account will continue to be taxed.

If the bondholder moved back to the UK, and nothing had been withdrawn whilst living in Spain, any growth on the bond whilst resident in Spain would be ignored by the UK tax office.

As an added benefit of reducing taxable income, wealth tax can be reduced. See this Wealth Tax in Spain article.

There can also be inheritance tax benefits with the bond when compared to the deposit account.

Well managed portfolios have consistently outstripped inflation. Conversely, deposit interest rates offered to savers have consistently under-performed inflation over the years.

To find out how we can help you with your existing investments and tax planning, and provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

* E&OE. The above is a simplified example for illustrative purposes and general guidance only.

How to reduce Wealth Tax in Spain

By John Hayward

This article is published on: 21st June 2023

Earlier this year, I wrote an article about the introduction of solidarity tax in Spain. This is a “temporary” (we shall see) tax on wealth for those with more than €3,000,000 in assets. This is in addition to wealth tax although any wealth tax due can be deducted from the solidarity tax bill. (This is not the case for residents of the Madrid or Andalusia regions as there is no Wealth Tax currently).

I have been working with clients who are affected by these taxes, trying to find ways of reducing the tax liability. Reducing wealth by gifting to, say, children is an option but that can create additional immediate tax problems. Also, for a number of different reasons, some clients are not willing to gift anything in their lifetime.

The amount of wealth Tax that has to be paid can be governed by income. Your income tax and wealth tax cannot exceed 60% of your total taxable income.

Example:

– Total taxable income is €40,000

– Tax payable €8,000

– Assets subject to wealth tax €3,000,000

– Wealth tax due €39,000

– The maximum that can be paid when adding income tax and wealth tax together is 60% of the total taxable income (€40,000).

– €40,000 x 60% = €24,000

Therefore, the maximum wealth tax that can be paid is €16,000 (€24,000 less €8,000 income tax).

However, having to pay €16,000 a year in wealth tax is still not particularly nice. What we can do is look at the income in order to see if this can be restructured. Notable targets for this type of planning are savings interest (more relevant at the moment) and income/dividends from shares and investment funds. By careful planning, we can provide the same level of income yet reduce the tax. Please visit this Tax Benefits of a Bond page which illustrates one of the major benefits of a correctly structured investment bond which not only reduces income tax but also helps to reduce wealth tax.

To find out how we can help you with your existing investments, pensions, and tax planning, and provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

Financial Top Tips in Spain

By Chris Burke

This article is published on: 11th June 2023

Thanks to everyone for their positive feedback on these newsletters. They are purely to give us ‘foreigners’ the heads up on financial matters that are at best opaque here in Spain. Before I head off to a chiringuito, as it’s that time of year, this month we shall be concentrating on the following important topics:

- National Insurance deadline to backdate/buy years in the UK – act now!

- What pension are you likely to receive as self-employed/autonomo here in Spain?

- How much money do I need to retire (with example) comfortably?

- Legal aid in Spain for British nationals

UK National Insurance deadline approaching

I meet many people who have contributed into the UK state pension (National Insurance contributions) and then move abroad. They may also pay into other countries´ state pensions, but the BIG potential issue is that no one knows for sure if these will be combined and what income in retirement you will receive. Some people say ‘Well they have to, otherwise it’s not fair and that’s how it works now/used to before Brexit’. I tend to focus on as many certainties as possible and always try to have a ‘more guaranteed’ plan instead of relying on what governments do and don’t do, as that doesn’t fill me with confidence.

I have met many people with 5 years’ state contributions here, 10 there and another 5 somewhere else and they don’t actually end up receiving ANY state pension. This is not the situation I want to end up with and that’s why I recommend to anyone who has existing UK NI contributions to continue to contribute to them, aiming to reach the maximum years needed to receive a full UK state pension. As a non-UK resident, if you are paying taxes in Spain it´s normally £12 a month to contribute to the UK system – for me it’s a no brainer.

With that in mind, normally you can ‘backdate’ or buy past years’ contributions to fill in any gaps you may have. However, from the end of July (next month), you will only be able to backdate 6 years, whereas before this deadline you can buy more. So, if you have significant gaps in your UK NI contributions you only have until next month to ‘fill’ a part of them. You can find out more here: National Insurance Gaps

Self-employed/autonomo state pension amounts

I wanted to clarify something that not many people here realise when they contribute into the social system as self-employed. In the UK you pay your contributions and the number of years you have contributed dictates, more often than not, how much you receive. However, this is not the case in Spain.

Many people are autonomo here and presume the monthly payment they make to the social security, if made over the necessary number of years, (currently 35), will give them the full Spanish state pension – unfortunately that is incorrect. That is because it’s not JUST the number of years you contribute, but also the amount you pay. Not many accountants will confirm that there is a choice on how much you can pay each month towards your social security – a low, medium or high amount. Therefore, most people pay the low amount for many years and only realise the problem when they start looking closer, usually at retirement age. I hope most people are sitting down when I tell you that if you paid the minimum contributions for the full number of qualifying years in Spain, you would receive around €643 a month, (almost half of the UK amount), whilst the maximum is €2,617.

That is why I recommend to almost everyone that they ensure as far as possible that they are fully contributed into the UK system by retirement.

Here are the links to HMRC to read about and organise this, (please don’t get in touch with me for help as it has to be done by yourself):

- Information on paying National Insurance contributions from abroad – gov.uk/national-insurance-if-you-go-abroad

- The Form to complete to pay Class 2 voluntary contributions at £12 a month – gov.uk/government/publications/social-security-abroad-ni38

You can obtain a state pension forecast here in Spain if you have a digital certificate here

As a local accountant recently told me, and I quote, “My personal opinion is that it is better that you make your own pension, saving the money and investing it directly, and more because each time the pensions are reduced year by year and it is quite sure that in the future they will be reduced most, but this is only my opinion…… This is what I decided to do a long time ago.”

So, my advice? Pay the minimum here, pay your NI in the UK and reach the maximum alongside making your own provision along the way.

How much money do you need for a comfortable retirement?

Now, this is a very difficult forecast to make given everyone’s very different lifestyles, so I must use a few assumptions based on the following:

- Average annual salary – €3,000 per month after tax

- Medium lifestyle choice in retirement

Therefore, one could surmise an income needed in retirement of €4,000 per month before tax could be the average amount required. If we say you receive the full state pension of around €1,000 per month, you need to supplement €3,000 per month.

If you had €300,000 and it gave you 5% return each year this would give you €1,250 per month – so we still need another €1,750 per month. Of course, this means that as you are taking the full interest earned from your money pot it is not keeping up with inflation. Therefore, taking 4% at most is more applicable which gives you €1,000 per month income. However, if this income falls under income tax (such as property income), then from earnings upwards of the current allowance of €6,700 each year at age 65 in Spain you will be taxed. Adding that to the state pension, (which is declarable for income tax in Spain), we probably need to say it’s more likely €800 a month net from this monetary income.

So, we see the problem, what do we need to do? In essence, make your savings/monies and assets work for you over the years with professional management, taking into account tax mitigation. The more money you invest and the longer the time, the more comfortable or higher probability you will achieve your goals.

By the way, the answer to the above question also depends on how you are receiving the income. Tax efficient savings will greatly reduce you tax liability away from income tax to the lower, (and with possible offsetting capability) of capital gains tax. In monetary terms, to be safe I would suggest €800,000 plus a property rented out in retirement, in today’s money, as an income will safely achieve this. Is that the average persons situation?

Legal aid in Spain for British nationals

The UK has just released the following information on legal aid available for those residing in Spain which is perhaps ‘better’ than I would have expected and well worth knowing: Legal Aid Spain

Click here to read independent reviews on Chris and his advice.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with Chris.

History: How it can save you money

By John Hayward

This article is published on: 31st May 2023

“If you think you have it tough, read history books.” Bill Maher

I was not particularly interested in history at school, mainly because the history masters (I went to a grammar school where we were taught by masters in moth-eaten gowns and who wore their ties outside their jumpers) would want to teach us about aspects that I had absolutely no interest in.

The Dark Ages, for example. They are called dark ages for a reason. These days I will happily surf the web (can we still say that?) going off-piste (no holding me now) and finding out brilliant historical facts that I am interested in and not what I am told to be interested in. Or maybe I am being told, in this Artificial Intelligence world that we now live in. Having said that, I have not felt any pressure to learn any more about the dark ages.

What is my point here? History is important because it can help us to make decisions. The problem is that, although we have plenty of information to refer to, and perhaps have taken on board, we all too often forget, or even choose to ignore, the “lesson”. In the investment world, it appears that everything that is happening now never occurred before. Or maybe it did but in a dark age when nobody was literate enough to write down what was going on.

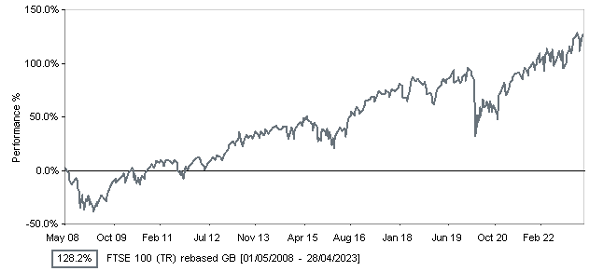

Sell low, buy high. Isn’t that a ridiculous investment strategy? It seems not, to some. I have been in the company of many people over the years who believe that they know when to sell and when to buy back in when “things are better/markets have settled/it is less rainy/the dog has been to the vet”. This strategy has consistently proven itself to be flawed. Although past performance is no guarantee of future performance, history can give us an idea of what could happen in the investment world after different global events. In more recent years, the financial crisis of 2008 and Covid-19 in 2020 have been big tests. After both “incidents”, those who stuck with it have been better off.

Source: Financial Express

Focusing on a stock market index that many British people are familiar with, the FTSE100, in the last 15 years to 1st May 2023, there have been 4 years that have been negative. I apologise for spelling this out but that means 11 years have been positive. 11-4. I like that score. The average annual gain of the index over that period has been almost 13%. Even more interesting is the tendency that a bad year is followed by an outstanding one. This is why, when people sell, they crystallise a loss and then possibly miss the best part of any recovery.

I understand that not everybody is comfortable with sitting out large falls (2008 and 2020). To cater for this, we have solutions within our armoury which limit the downside whilst still providing long-term growth.

To find out how we can help you with your existing investments, and/or provide you with ideas for the future, contact me today at john.hayward@spectrum-ifa.com or on +34 618 204 731 (WhatsApp)

If you are feeling down, pick up a history book. It is certain to take your mind off your woes.

The Top Tips in Spain | May 2023

By Chris Burke

This article is published on: 15th May 2023

Summer is well on its way, lighter evenings and enjoyable temperatures are here for most and we will soon be commenting on how hot it is, I am sure!

For this month we shall be concentrating on the following topics:

- Driving licence swap now active

- UK investments/ISAs compared to Spanish options

- UK tax code changes – beware!

- State pension retirement options in Spain

Driving licence swap now active

From the 16th March 2023 the UK & Spain driving licence exchange, without the need to take a practical or theory driving test, is back at long last for those who are Spanish residents. From this date, as a resident you can legally drive in Spain on your UK driving licence, having 6 months to exchange.

You will also need to book a ‘Psicotecnico’ as I previously mentioned in my Newsletter and here is a link for the participating places to do this: Psicotecnico centres

So get your driving gloves back on and hit the Spanish roads! Be aware, this new exchange deal between the UK and Spain also means they will be sharing information on fines, speeding tickets and other incidents recorded (intoxication for example) so take note.

UK investments/ISAs compared to Spanish options

Many people who live in Spain are unclear or unaware of the difference between holding UK savings and investments compared to Spanish, and also what your options actually are here.

Unless you are on a specialist tax regime such as the Beckham Law, or potentially the new Digital Nomad Visa, Spain views UK savings and investments as non-Spanish compliant and therefore tax declarable/paid on any gains annually, EVEN if you do not access any of these monies. In the UK for example, normally the first advice any financial adviser will give their clients is to ‘max out’ their ISA and private pension contributions annually, as the tax saving alone makes this a great thing to do. However, once you become a Spanish tax resident these are not generally tax efficient and any gain on non pension related investments has to be declared and tax paid annually – therefore in many cases potentially nullifying the benefits of these.

So what can you do?

Most people speak to their Spanish bank and aren’t given any financial advice as such in respect of their circumstances and, in many cases, are sold investments that are not really what they are looking for, nor, dare I say, are any good from what my clients tell me!

When they have been put off by this they start looking around for something similar to what they had before they moved to Spain, and that’s when they find and/or are recommended to me. In Spain, we have access to several flexible investment solutions backed by some of the UK’s largest and well-known institutions. These products are EU regulated and highly tax-efficient, in essence similar to a UK ISA. We start by looking at your overall situation, carefully understanding what you are looking to achieve – whether that be a retirement plan, mid-term investment or complete financial planning for the whole family, taking into account university fees, or perhaps FIRE (Financial Independence, Retire Early). As the years go by and your money grows we provide ongoing advice to make sure these are optimised, taking into account life events that occur along the way.

UK tax code changes – beware!

On the 10th April this year UK state pensions were increased to rise with inflation up to £203.85 a week (10.1% increase) as the government restarted the ‘triple lock’ agreement it had suspended for one year. For most people receiving their UK pensions this was very good news, however for some it has created another problem depending on other income and how they are set up for tax purposes.

When leaving the UK as a tax resident it is important to inform HMRC. If you don’t, once your income rises above your personal allowance of £12,570 (with the state pension annually now £10,600) you will be subject to income tax in the UK and taxed accordingly.

Worse than that, this hike in UK state pension income has seen many retired people have their tax code changed, wrongly it would seem, by HMRC. In one case I have seen they were being taxed 40% on their income above the personal allowance. If the tax they are taking doesn’t look right a simple phone call to HMRC seems to solve the problem.

If you have set yourself up correctly as a non UK tax resident, then the only UK income you should be taxed on is property rental income. Most other income should not be taxed in the UK, but declared and tax paid in the country where you are tax resident.

State pension retirement options in Spain

Below I have listed the different options when you retire in Spain claiming a state pension – one notable new change is that to qualify for ‘partial retirement’ (also known as active retirement) you can only use Spanish contributions – previously you could include contributions from the UK.

Ordinary Retirement

Retirement age in Spain starts at 65, however for most it is 66 years and 10 months and by 2027 the number of years of contributions to retirement needed will be 38.5 years.

Flexible Retirement

After you retire, you can combine receiving a part of your pension with part-time work (reducing your full working day down to 50%). Your pension is reduced proportionally.

Partial/Active Retirement

If you have not reached the legal retirement age, you can combine a part-time employment contract with receiving part of your retirement pension.

**Reminder – to qualify for the Spanish state pension in general you must have contributed for 15 years, of which two at least should fall within the 15 years immediately preceding the start of your entitlement.

If you would like any more information regarding any of the above, or to talk through your situation initially and receive expert, factual based advice, don’t hesitate to get in touch with Chris.

A tax haven called Andalucia

By Charles Hutchinson

This article is published on: 24th April 2023

In recent years, the debate surrounding wealth tax has gained significant attention, especially in the context of Spain’s Andalucia region. Andalucia is one of the most populous regions of Spain and has a strong agricultural and tourism-based economy. In September 2022, the Andalucian government announced the abolition of wealth tax.

The decision to abolish wealth tax in Andalucia was based on the regional government’s belief that it was an unfair tax and discouraged investment and economic growth in the region. The tax was seen as a deterrent for high-net-worth individuals (HNWIs) and business owners, who were seen as crucial for job creation and economic stimulation.

However, critics of the decision argued that wealth tax was an important source of revenue for the government and helped to reduce inequality in the region. They argued that the abolition of wealth tax would only benefit the rich and widen the gap between the rich and poor in Andalucia.

To address these concerns and also that it was unfair to all other autonomous regions (except Madrid which also scrapped wealth tax), the Federal government introduced a new tax called solidarity tax. Solidarity tax is a progressive tax that aims to reduce inequality and generate revenue for the government. It is applied to all autonomous regions. If a region has no wealth tax, then the solidarity tax is applied. If, however, a region already has wealth tax in place, then the solidarity tax is removed. The tax is based on a sliding scale, starting with HNW individuals with assets of €3m and above. There are three bands, the lowest rate being 1.7% which rises to 3.5% on assets worth €10m and above.

The introduction of solidarity tax was seen as a positive step by many, as it addressed concerns about inequality and raised much-needed revenue for the government. However, some critics argued that the tax was not enough to make up for the loss of revenue from the abolition of wealth tax. However, it has allowed many to escape wealth tax on assets under €3m, especially if those assets are held jointly. This is seen as attractive by many resident expatriates as it mitigates the impact of wealth tax (in effect there is no wealth tax for a couple on assets below €6m).

In the case of Andalucia, the abolition of wealth tax and introduction of solidarity tax highlights the ongoing debate about the role of taxation in reducing inequality and promoting economic growth. While some argue that wealth tax is an important tool for reducing inequality, others argue that it discourages investment and entrepreneurship. What is clear is that it is part of a concerted move to make the region attractive to those who would stimulate economic growth. For example, inheritance tax has been removed and capital gains tax scrapped on all first homeowners over the age of 65. Income tax is being lowered by at least 4% and water tax has also been abolished. All of which represents a strategic move to lure back permanently those who had moved away, including to nearby Portugal for example. Ten of the top 20 wealth tax payers in 2019 left Andalucia in 2020, resulting in a loss of income for the region of nearly 18 million Euros (3.5 m in wealth tax and 14m in personal income tax).

The Spectrum IFA Group is committed to helping expatriates navigate their way through the taxation minefield. Our disciplined financial advice process ensures that valuable planning opportunities are fully utilised, for optimal tax efficiency on assets, income, investments and, eventually, inheritance for your beneficiaries. By doing so, we can demonstrate, perhaps surprisingly to some, that Andalucia truly is a tax haven, not just in Spain but in a wider European context.

Whether you are planning to move here or are already a full time or part time resident, please contact me for a no fee and no obligation chat – perhaps over a coffee?

Protecting your investments during the Ukraine conflict and beyond

By Charles Hutchinson

This article is published on: 18th April 2023

The ongoing Ukraine conflict has had a significant impact on global financial markets and the value of investments. While it is difficult to predict the exact outcome and duration of the conflict, there are several strategies investors can employ to protect their investments during this uncertain period. Here are some suggestions:

1. Diversify your portfolio: One of the most important strategies for protecting your investments during a period of geopolitical uncertainty is to diversify your portfolio. By investing in a variety of asset classes such as stocks, bonds, commodities, and real estate, you can spread your risk and reduce the impact of any one investment being affected by the conflict.

2. Avoid investments in affected regions: If you are concerned about the impact of this conflict on your investments, it may be wise to avoid investing in companies or industries that are directly impacted. For example, companies that do business in Ukraine or Russia, or companies that rely heavily on imports or exports from these regions, may be more vulnerable to a serious and sustained downturn.

3. Consider safe-haven assets: During times of geopolitical uncertainty, investors often flock to so-called “safe-haven” assets such as gold, US Treasuries, and the Swiss franc. These assets are generally considered to be less risky than other investments and, depending on wider market conditions, can provide a hedge against volatility.

4. Keep an eye on news and developments: It is important to stay informed about developments which may affect financial markets. By keeping a close eye on political and economic news, investors can make informed decisions about their investments and, if necessary, adjust their portfolios accordingly. Note that becoming overly reactive to short term events will usually be counter-productive, but staying informed will also often present valuable opportunities for tactical portfolio adjustments.

5. Take a long-term view: While it can be tempting to react to fluctuations in the financial markets, it is important to remember that successful investing almost always relies on patience and taking a long-term view. Rather than trying to pre-empt short term market direction, it is often more prudent to focus on your long-term investment strategy and stick to your plan.

6. Consult with a suitably experienced financial adviser: If you are uncertain about how to best protect your investments, it may be helpful to consult us. A professional adviser can help you navigate the complexities of the financial markets and provide personalised advice based on your individual goals and risk tolerance.

Points 1 to 4 above are actually the responsibility of the fund managers whom we select for their prowess, long term performance and consistency. It is their job to navigate your investments through uncertain times. Point 5 is vital and it is important to remember the adage “It’s not timing the market, but time in the market, which matters”.

In conclusion, the ongoing conflict in Ukraine presents a challenging environment for investors, but there are strategies that can be employed to protect investments. By diversifying your portfolio, avoiding investments in affected regions, focusing on safe-haven assets, staying informed about the latest developments, considering the long-term and consulting with a financial adviser, you can help protect your investments during this uncertain period.

Arts Society de La Frontera

By Charles Hutchinson

This article is published on: 11th April 2023

The Spectrum IFA Group again co-sponsored an excellent Arts Society de La Frontera “Live” lecture on the 15th March at the newly renovated San Roque Golf & Country Club on the Costa del Sol. We were represented by one of our local and long-serving advisers, Charles Hutchinson, who attended along with our co-sponsors Currencies Direct represented by Ignacio Ortega, Carol Schleisman and Cristina Ruiz. Also present was the society’s European Chairman Jo Ward.

The Arts Society is a leading global arts charity which opens up the world of the arts through a network of local societies and national events throughout the world.

With inspiring monthly lectures given by some of the UK’s top experts, together with days of special interest, educational visits and cultural holidays, the Arts Society is a great way to learn, have fun and make new and lasting friendships.

At this event, over 50 attendees were entertained by a talk on The Manufactured Woman which is the story of Pandora, her box and the reasons for her creation by Mary Sharp of BBC Radio 4 fame. She gave an interesting talk showing comparisons with other created female characters such as Eve in the Bible and Eliza Doolittle in Pygmalion and the later My Fair Lady.

The talk was followed by a drinks reception which included a free raffle for prizes including CH supplied book on Dutch Art and Champagne. Smart Currency Exchange also supplied wine presentation cases with glasses and Brandy.

All in all, it was a good turnout and a successful event at a wonderful venue. The Spectrum IFA Group was very proud to be involved with such a fantastic organization during its current global expansion and we hope to have the opportunity again at the November lecture.