I don’t think I have ever wanted to leave a year behind me as much I did 2022. Well, maybe 2008/2009, but 2022 recorded as one of the most brutal in my career. No matter which direction there only seemed to be bad news. Thankfully we have passed into 2023.

So what does 2023 have in store?

By Gareth Horsfall

This article is published on: 1st February 2023

So what can expect from 2023?

Working with The Spectrum IFA Group means that I am invited each year to their annual conference where we are invited to listen to a number of fund / asset managers who can give us some insight into what has happened and also where things might be heading. This conference was a special one because it was the 20th anniversary of the The Spectrum IFA Group and so the event was held at Gleneagles in Scotland. Apart from the cold (average -2 degree), the conference went well and I managed to scribble some notes from the various speakers, my favourites being David Coombes from Rathbones Asset Managers, Rob Gordon from Dreihaus/VAM Investment funds and Rob Clarry from Evelyn Partners.

(Disclaimer: It should be noted the views expressed here are my own. The information collected has been interpreted by me and can only be taken as such. To protect the names mentioned above none of this article should be taken as advice, recommendations or an offer of solicitation from the fund/asset managers themselves or the companies they represent).

“Heads of State don’t have a clue what they are doing…yet they think they can predict the future”

This was how one asset manager (who shall remain unnamed) started his presentation. The point being that if we are basing our investment ideas and knowledge on economists, central banks or governments themselves, then it is almost certain that you are going to get it wrong.

But don’t just take my word for it, let’s looks at some investment examples that didn’t go well in 2022, and which prove the case:

1. Wind Power is the future…but is it? It produces only when the wind blows, it is significantly more costly than traditional energy sources. The amount of ecological damage to build wind turbines in terms of resources required and to install them probably far outweighs the benefits if you place it against other alternative energy sources. In addition, the blades have a lifespan of approximately 10 years then they need to be replaced and buried somewhere because they cannot be recycled. Yet, faced with all these facts and a sector heavily subsidised by government money, a Danish wind power company: Vestas, which has never turned a sizeable profit was worth more than Apple at one point.

2. Cryptocurrency: There is not a lot to say about Crypto in 2022 other than a complete investment disaster. Bitcoin lost 60% of its value in 2022. A pretty high risk asset if ever there was one. Crypto was also plagued by the collapse of FTX with literal losses ( i.e lost and likely never to be found) assets of $1-2 billion. Hackers also stole $4.3 billion of cryptocurrency in 2022, an increase of 37% from 2021. Yet, governments tell us that government backed crypto-currencies are the future. I will stick with cash, thank you very much!

3. Tesla and Elon: How the darling of the investment world, and government officials alike, has been ousted from his perch. A bit like crypto currency Tesla lost 65% of its value in 2022. You might argue that he is changing the world with his electric vehicles, yet did you know that Volkswagen made more electric vehicles in Europe in 2022 than Tesla? So, who is changing the world? His move to Twitter should also raise eyebrows. A company worth $40bn on the world’s financial markets which has yet to show a profit and one which he also says will ‘change the world’. Remain a sceptic!

4. Inflation is transitionary: Governments also said that when the inflation train left the station in 2020, that, at best, it would be, quote, ‘transitionary’. i.e it would go away once post Covid supply chains returned to normal. I never believed this and wrote about it on a few occasions in the last couple of years. Let me tell you that inflation is here to stay…and would you like some numbers on that? Well David Coombes from Rathbones hazards a guess that inflation will continue at approx 4% in the US, 3-4% in the EU and 5-6% in the UK as an average over the next 3 years. I suspect those are headline ‘government’ declared rates. My guess is that real inflation may be somewhat higher. Protecting those savings and investments has never been more important.

Did you know that inflation needs to only run at 7% per annum for 10 years for the value of your money to halve. 2022 ‘true’ inflation was more like 10-15% across Europe, so that’s 2 of those 10 years taken care of already.

So with all this doom and gloom, what actually did do well in 2022?

Answer: The old, out of favour, industries of the past: BP, Shell, Lockheed, Schlumberger, Caterpillar et al.

Yep, those very same industries which no one wants to invest in any longer. They turned the corner and became the star performers of the investment markets. In fact, anything moderately related to ethical / sustainable / ecological investment had the hardest time in 2022. It was enough to test anyone’s ethical investment values!

However, the truth of the matter is that with interest rates likely to be higher in the next 5 years than they have been in the last 5 years, and the cost of debt being significantly higher, we may just see some of the older, cash rich industries doing quite well, and seeing some of the newer debt heavy companies struggling or even going bust.

Take Netflix. (It has become my go to TV channel!). Netflix’s business model is built on continual expansion of its subscribers and content. However, it has been heavily funded by cheap debt. How might it progress in a world where the debt it needs to make a new series costs 5 times more than before? I suspect it might survive this new world it finds itself in, but could it become a takeover target from a more established and cash rich company, like Disney?

Another example of one of those new, sustainable, ethical businesses, potential disruptor / game changer was Impossible Meat. For those that are not aware they are producing plant-based meat alternatives. In 2022 they saw their share price fall 96% as consumers turned away from their product. (I tried them myself and can’t say I was too impressed!). An example of governments pushing us towards more plant-based and lab made foods, not to forget bugs. But can they accurately predict the future?

So, the cost of servicing debt is certainly going to reshape the investment world again, yet there is one major theme which will shape the world in years to come: SECURITY and I don’t just mean military security, but also energy and food security.

Energy Security

Energy security is being driven by the war in Ukraine and the end of the reliance on Russian cheap energy. A perfect example of how energy policy is needing to change focus is Giorgia Meloni’s recent trip to Algeria to agree access to their gas fields, and export into Europe. Algeria has the 11th largest reserves in the world and have a gas surplus. Italy is trying to line itself up as an energy hub for Europe given that gas will likely now come in from the global south rather than the north, and Italy, it would seem, is ideally placed as a central Mediterranean country and its access into the EU. The only snag, which is not much talked about, is the fact that Algeria is a Russia ally and currently buys fighter jets from Russia and supports it in the war with Ukraine, so how the Italy/Algeria agreement will work is anyone’s guess.

Military security

Military security for the EU is still going to come from NATO (i.e US led military policy). It could be argued that the Ukraine war is not in the EU’s interests, in particular Germany, but they have to kowtow to NATO/US driven policy because the EU never could agree on building an army of its own to defend itself, and hence self- determination in terms of defence policy. There is no other real option and so the EU will very likely continue to arm Ukraine and stretch out the war if that is what US policy dictates, even when negotiations to end it might be possible. The order books of most armament / defence companies will be very full for some years to come.

Food security

This was an area which provoked more discussion from the fund managers. In particular how the West will need to develop to ensure that food is still delivered to our supermarkets.

A good example of a company that is innovating in the area of food security is John Deere. The agricultural machinery and tractor marker. They have already developed a fleet of unmanned vehicles which can plant, monitor and harvest. These machines are no longer human driven one-purpose vehicles. They are machines with embedded computers, checking soil temperature and microbe levels, adding fertilizer when needed and checking weather signals, determining when to plant, when to harvest etc, and all without any human intervention in the field. The biggest customers will ultimately be the biggest producers, namely the US, Brazil and Ukraine (you may be surprised about Ukraine being in the list, but a benefit of war for large industries is that they can take advantage of disaster capitalism. Large US and International agricultural companies have been able to take advantage of new laws liberalizing the sale of agricultural land in Ukraine. Previously, Ukrainian small farmers were protected and forbidden to sell their land to large agro interests. Now, big companies are moving in to take charge of Ukrainian land. On one hand the farms will benefit from economies of scale, but the small-scale sustainable farming model will struggle to survive).

Agricultural and food production will be a big investment theme in the coming years!

So, with all these themes in mind, the broad outlook for the future and investment, according to Evelyn Partners, will be determined by 4 main Megatrends.

- SHIFTING DEMOGRAPHICS

- CHANGING WORLD ORDER

- BUMPY ENERGY TRANSITION

- TECHNOLOGICAL REVOLUTION

I won’t bore you with details in each area, but here are some points around the subjects discussed:

SHIFTING DEMOGRAPHICS. Ageing populations, more opportunity for pharmaceutical companies and drug development, more use of online doctoring and diagnosis, roll out of robots in our hospitals and clinics (robot cleaners, robot secretaries, robot surgeons, robot beds moving freely from ward to surgery room without the need for people). It’s all coming and given that 80 out of every 100 people will be over the age of 65 by 2050 in Japan, and around 60 in 100 in Europe, it is difficult to see how our world will survive without increased development and innovation in the healthcare sector.

CHANGING WORLD ORDER. The US/China decoupling will continue and accelerate. Instead of globalisation, think ‘slowbalisation’. The war in Ukraine has driven a wedge between those, already weak, alliances. Russia, Iran, China, Saudi Arabia, India, (the BRICs+) and other countries are coming together to find ways to subjugate control over their regions and wrest control away from the US, especially in the use of payment systems in USD. The US will, of course, fight its corner, just look at its policies around the semi-conductor market which you will have read in my last E-zine ( ) What investment opportunities this will throw up is anyone’s guess, but the exportation of the US model of capitalism around the world, will slow and this could throw up new investment opportunities in new companies further afield.

BUMPY ENERGY TRANSITION. We are only going one way with energy policy, and that is more towards sustainable energy production; but, if you think we will be switching off the oil taps and shutting down the coal fields overnight, as many Eco groups would wish for, you will be very disappointed. (I will place a bet that in 20 years we are still using the same amount of oil as we are today, but that’s just a personal hunch. A lot of electric cars are going to need a lot of electrical energy from somewhere). A transition will happen but technology and storage of energy will need to improve, solar and wind power will just not make up our energy needs.

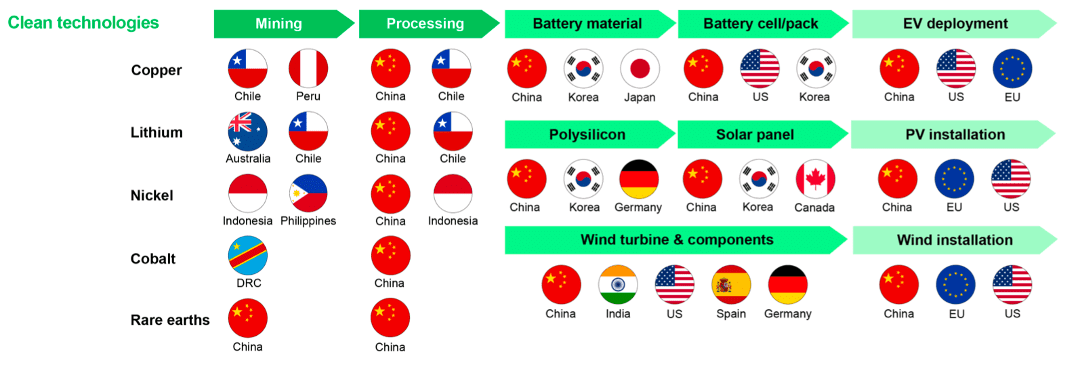

In addition, a little known point about the resources required for a sustainable energy transition: China dominates!

So, whilst the US imposes sanctions on China in the access to and production of semi conductors, China could retaliate with sanctions on the west regarding access to the materials needed to transition to our green economies. Yet, China needs to import 70% of its food from abroad as it is not able to produce enough to feed its population. The US is the biggest producer of agricultural products. So, from a bumpy energy transition we revert back to point 2, The Changing World Order. It will be an interesting time ahead for global politics.

TECHNOLOGICAL REVOLUTION. We have already seen so much revolution in this space since the year of my birth 1974 but the future will accelerate things even more. From next level automation in industry and daily life, 3D and 4D printing will become more the norm (I went to a fayre in Villa Borghese in Rome last Sunday and one stall was 3D printing some items on a wooden work bench) with the launch of 5G we will become even more interconnected, more reliance will be placed on cloud computing and storage of data, next-gen quantum computers, AI and controlled devices, cryptocurrencies, wearable devices…the list goes on.

And if that is not enough to scare you then check out the company recently purchased by Microsoft called ChatGPT. This is a learning AI application which can do just about whatever you want it to do. Think of it as an Alexa x 1milllion! It can provide you with any amount of information you need, ‘write newsletters’ – you just give it a subject and in seconds it will provide you with a written text on a certain subject, do maths, solve problems, write a website for you, some students are even using it to write essays at University. The scary thing is that it learns as it goes. Anyway, you don’t have to worry about my E-zine being written by ChatGPT; I don’t even think the best learned AI could imitate my crazy style.

And more food for thought

Rob Gordon (US citizen) from Dreihaus/VAM Investment funds thinks that Trump will win the Republican nomination again. But he thinks that Jo Biden, at 81 years of age when the election comes around, will win against Trump again.

David Coombes from Rathbones Inv Managers thinks that GBP will drift back into the range of 1.25/1.30 against the Euro within the next 3 to 4 years .

Lessons learned from this conference

This might sound like a sales pitch: something I try to avoid in this E-zines as they are written for information purposes only. However, whilst listening to our various speakers I became overwhelmed at just how complicated the world is becoming from a political, technological, economic and investment perspective. We can no longer ‘pick a stock’ and expect it will do well. Thought and research needs to be behind investment decisions. It’s easy to think that we can invest ourselves, be successful and then years like 2022 come along and there is nowhere to hide: stocks and bonds prices fall together, and then the only safe space is in some highly volatile areas of the commodity sector, which you wouldn’t normally play in. We need professional help and guidance to help us navigate these choppy waters head, but when there are so many changes afoot, it throws up the best investment opportunities. The investment managers and companies we use and talk to regularly are on top of these trends and can help you, our client, to get the best from your investments. The lesson learned from this conference: you are in good hands.

As always, if you have any questions about this E-zine or have any general financial planning concerns as a resident in Italy, or someone who is thinking of moving to Italy, then don’t hesitate to get in touch on email: gareth.horsfall@spectrum-ifa.com or on cell: +39 3336492356

Will China invade Taiwan?

By Gareth Horsfall

This article is published on: 23rd December 2022

Well, it’s nearly that time of year again and I thought I would subject you to a last dose of Gareth’s musings before the year closes.

They say that the years pass more quickly the older you get, but I am not sure just how much quicker they can fly by based on how this one has zipped by.

So, it is with this in mind that I thought I would write something nice and Christmassy for you: Why it’s unlikely that China will invade Taiwan…..at least for the foreseeable future! What more could put our minds at rest this Christmas than a rational argument as to why China is unlikely to start another war in 2023 just when we have plenty of others to contend with.

OK, it doesn’t necessarily have a festive feel to it, I understand that, but I bought a book this year written by Louis-Vincent Gave who is one part of a company called Gavekal. They provide very high level statistical, political and economic analysis to businesses and governments around the world. They are quite famous in this area and their work is exceptional. The book is entitled ‘Avoiding the Punch: Investing in uncertain times‘. In it there is a section on exactly why China is unlikely to invade Taiwan, at least for now. Since this was a concern expressed by more than just a few clients this year (presumably given our Western media tendency to constantly be baiting us into believing that it is imminent),I thought it might make a nice E-zine to finish the year and give us some hope for 2023. As they say, knowledge is power…and I would add less angst!!! :0)

It’s all about semiconductors.

Yes, the whole business of China invading Taiwan and the USA threatening to protect the island, whatever it takes, is all about semiconductors but if, like me, you are wondering exactly what we use semiconductors for, the following should give you a quick answer:

Semiconductors are an essential component of electronic devices, enabling advances in communications, computing, healthcare, military systems, transportation, clean energy, and countless other applications.

In essence, they are now used in almost everything that we ‘need’ to run our daily lives. From your phone to computer to thermostat, clocks, TV’s, machinery in factories, the MRI machine at the hospital, wind turbines etc. We can’t live without them. So, for any nation state it is important to have access to the companies, and countries, that monopolise the manufacture of them.

Control of the market in chip making has for a long time been monopolised by the USA through the tech firm Intel. But, in July 2020, the US were taken aback when Taiwan Semiconductor Manufacturing Co (TSMC) announced that they had technologically leapfrogged Intel in the business of high-end chip making.

(The USA started a trade war with China over semiconductors in 2017/18 when they placed restrictions on the export of semiconductors to Huawei, ZTE and other Chinese companies which brought those companies to their knees).

However, like all fairy tales, there once was a time when the USA and China sort of got along with one another. The days when Taiwan made those nice little plastic toys and bicycles that they would export into the West, and no one felt threatened. However fast forward to today and they are now arch enemies just at the time when Taiwan has now surpassed Intel to become the No 1 producer of the world’s most important commodity.

So, the real battle ground is not Taiwan itself (which interestingly, the USA recognises Taiwan is a part of China, but does not recognise China’s sovereignty over the island) but for the control and continued access to the global semiconductor market.

1. If China were to invade Taiwan it would surely result in Taiwan’s semiconductor factories being damaged and/ or destroyed. Even if China invaded by sea, Taiwan would have time to self-sabotage the factories and keep hidden any secrets in the manufacture of this precious commodity. Since a third of China’s semiconductors are supplied by Taiwan, it would shut down China’s tech industry for which there would be no other supplier. China has placed significant importance on the development of its tech industry as part of its growth strategy and so this would be a backward step.

2. Military conflict with Taiwan would limit, if not cease, China’s ability to make these semiconductors at home. Factories that produce these highly specialised chips need an investment of close to $20 billion just to be functional and most of the machinery required to make them comes from Japan, the USA, the Netherlands and South Korea. All countries which would likely cease trading with China if it invaded Taiwan.

Strangely, what might speed this process along (and a potential invasion of Taiwan) is America’s continued actions to strangle China out of the semiconductor’s market. On 7th October 2022 the USA imposed new sanctions on China by restricting the supply of equipment and tools to any manufacturer of semiconductors in China. Not only, but also any US person, green card holders and foreign national of the US are prevented from going and working in a Chinese semiconductor production facility without first obtaining a licence, therefore making it virtually impossible to do so. (Strangling the ability for China to hire the talent to train their own engineers)

You might think this would slow China down, but it’s quite the opposite because as a result of these sanctions the Chinese government have now placed an even greater importance on the development of science and innovation in their economy. The US sanctions have had the adverse effect of aligning Chinese business interests with the Chinese government itself. Both are now convinced that they cannot rely on anyone but themselves and certainly must not be dependent on US (and its allies) sourced goods/materials. Hence the Chinese government and Chinese businesses are collaborating to build domestic alternatives to imported technologies.

The question of building a domestic semiconductor sector in China has moved from being a business decision to a matter of national security, and for businesses a matter of survival.

So, you might be thinking what is the time line for China becoming self-sufficient in the manufacturing and technology surrounding its own domestic market for semiconductors? The answer: around 2030 according to various sources. So, a Taiwan invasion, might be a few years off yet! All the sabre rattling between the US and China is likely to be just that for some time to come.

If you would like to discuss this or any other subject relating to how the economic, social and political events in the years ahead might affect you and your personal financial plans, then you can contact me on gareth.horsfall@spectrum-ifa.com or on cell +39 333 6492356

And on that happy note..

Declaring your taxes in Italy

By Gareth Horsfall

This article is published on: 9th November 2022

I had a nasty surprise the other day and I just had to tell you about it. I got one of those dreaded pec (posta elettronica certificata) emails with the title ‘Agenzia delle Entrate – riscossione‘. They put the living fear into me and for obvious reasons. This time it was nothing significant, but still an issue relating to something my old commercialista did, or didn’t do, back in 2012, 2015 and 2017. My new commercialista has launched an investigation and hopefully we can park that particular communication in a draw somewhere, but I suspect I will end up having something to pay.

Why you should ask for a copy of your Unico!

With my horrible experience in mind, I decided to write this article where I want to just briefly touch on why you should really be asking for a copy of your Unico from your commercialista or whoever declares your taxes.

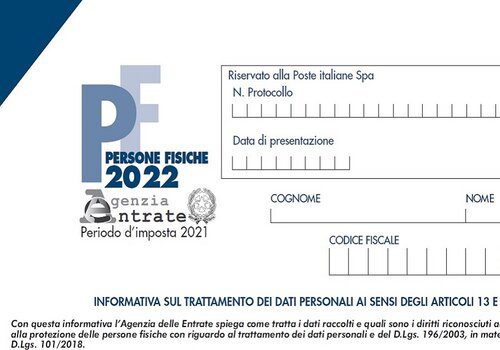

If you are unsure what an Unico is, it is merely a copy of your declared tax return pages that have been submitted to the Agenzia delle Entrate.

And will normally be about 20/30ish pages long, depending on how complex your financial affairs are.

You also want to request a copy with the receipt on the back pages, as this is confirmation that it has been lodged with the tax authorities.

That page should have a header as follows:

Now, you may ask why I am telling you this?

In the last few years, I have widened my services to my clients to incorporate a check on their declared financial affairs in Italy, to ensure that everything is being reported correctly. I decided to do this because it had become apparent that some errors had been made by various commercialisti and the odd client had been incurring higher taxes than necessary, as a result.

Checking your tax return may seem a complicated procedure, and you may be reluctant to do so, but actually, for most of the International English-speaking community living in Italy the entries in the tax return should be relatively simple. Apart from any declaration of income, which you would find under section Quadro RN or RT for investment income, you can also check on things like your accrued medical expenses under Quadro RP.

[An interesting point about the medical expenses section is that this year my commercialista contacted me about my receipts for farmacia expenses for 2021. However, he didn’t just asked me for the scontrini, but actually sent me a screenshot from the Agenzia delle Entrate website detailing all my farmacia spending for the whole year, where I had given my tessera sanitaria, which I found quite unsettling!]

The main sections that I would suggest that you check over are Quadro RW and RT. These are where overseas assets, incomes and capital gains have to be declared. These include properties, portfolios, bank accounts and other overseas assets, such as art or vintage cars, for example. These are the sections where I find the most errors. It might be that the market value of a property has been reported instead of a purchase value or local authority value or they have misunderstood the nature of a pension and declared it as an investment portfolio.

Also, remember when checking these figures that they must be converted into EUR from the foreign currencies in which you may have an asset. To do this you need the exchange rate for your respective currency. The Agenzia delle Entrate publishes those conversion rates and where valuations have been provided for the 31st December, for example, then you would need to use the declared rates from the Agenzia delle Entrate for that month. The link below takes you to the AdE provvedimento for Dec 2021 that provides exchange rates on all world currencies.

In more recent years, where I have started working with commercialisti more closely for my clients, I have managed to iron out these problems and, in most cases, a good commercialista will be happy to learn the nature of an overseas asset and ensure it is declared correctly. However, there are still instances where mistakes can be made.

In brief, I would advise you to request a copy of your Unico for the last financial year. A good commercialista shouldn’t be worried about providing you with a copy. There shouldn’t be anything to hide if they have done it all correctly. You can also download this directly from the Agenzia delle Entrate (AdE) website. If you have not already done so, you can request access details to register with the AdE from a local office, and then create your access point. If you have a SPID (Sistema Pubblico di identità Digitale) you can access the website using this means, which is much easier. You want to find section Cassetto Fiscale > Dichiarazioni Fiscali.

Do a check of your declared financial position! There is unlikely to be anything wrong in most cases, but you may just be the one who is paying more than you need to because of an incorrect code or misplaced figure. Do not leave the exclusive responsibility of your finances in the hands of your commercialista or fiscalista and if you are unsure of how to interpret the data in there then you can always ask for my help by contacting me on: gareth.horsfall@spectrum-ifa.com or call/whatsapp on +39 3336492356

Bonus and Superbonus Edilizia

I have been asked a number of times recently about whether I think the new Italian government will stop the current range of bonuses for doing work on your property and/or upgrading your white ‘elettrodomestici‘ goods. Well, I had written a long article explaining the hypothetical new arrangements that could be announced to begin in 2023, only to be usurped by the Italian government which have now announced how things will change for 2023, as I explain below.

My thinking has always been that they are likely start to phase the bonuses out rather than cull them altogether. But, I can’t see a long-term sustainable economic plan for the country with continued ‘Bonus Edilizia‘ at the current levels, particularly the 110% bonus.

Under the legislation brought in by Draghi the 110% Bonus would have been in place for the whole of 2023, after which it would fall to 70% in 2024 and 65% in 2025. For ‘ville‘ and properties which are classified as ‘unifamiliare‘ the bonus would only be available until the end of 2022. But this is Draghi legislation. He has now gone and the new administration want to put their stamp on things, hence the revised measures coming into force from Jan 2023.

So, the new measures announced last week are as follows:

1. The superbonus will be reduced from 110% to 90% from the 1st Jan 2023 for all condomini (buildings with more than one property).

For ‘unifamiliare‘ properties, i.e villa’s or standalone houses, the same percentage will be offered, as long as it is used on the ‘prima casa‘. However, a new measure for ‘unifamiliare‘ properties has been added. They will now also assess the ‘reddito familigiare‘ of the occupants of the property and reduce any bonus accordingly. The maximum income and formula for the reduction in bonus have yet to be announced.

Possible reductions/removals

No mention has been made as to whether the superbonus will still be available or reduced significantly for ‘seconde case‘. The proposals for the ‘seconde case‘ could range from anywhere between 50% to 65% or a complete removal altogether.

The other notable plan is that the Agenzia delle Entrate have been given more powers to ramp up the controls and investigations for bonuses. More paperwork requirements are expected to be demanded to ensure that the monies for the work end up in the hands of the people actually doing the work, at a fair price and not artificially hiked to exploit the bonus regime.

As for all the other bonuses for electric white goods, etc. It looks like they will be here to stay for the coming year/s, at the very least. (Ecobonus, Sismabonus, Bonus mobili e elettrodomestici, Bonus Verde, Bonus idrico, Bonus acqua potabile, Bonus Facciate, Bonus ristrutturazione, Bonus restauro, Bonus prima casa under 36, Bonus affitti giovani under 31)

The final details have not yet been ironed out and knowing the normal process for the Legge di Bilancio we may not know the final details until after the 1st Jan 2023.

Since the superbonus scheme started the Italian government have now paid (or are awaiting payment) of €51 billion of tax rebates. The objective is to reduce that to €31 billion for the period between 2023 and 2028.

For anyone looking to apply for the ‘Bonus Edilizia‘ right now, my suggestion would be to get your requests in and push the people who are making the application on your behalf to make sure that you qualify for the current bonus amounts. If not, you may find the amount you get back is lower than you had expected.

Have you made your ‘Folder’ ?

By Gareth Horsfall

This article is published on: 6th November 2022

I prefer to start an article on a positive note but unfortunately have to start with a sad event that happened recently in our lives. My wife’s grandmother died on the 8th October at the ripe old age of 94. She was very ill in the end and as it has been said many a time for people in her condition, that it was a blessing in the end. However, it is obviously a sad time for the family. I will remember her fondly. I knew her for 18 years and she was a very Southern Italian ‘Mamma’ type. Always keen for you to take more food from the table (resulting in my first few years in Italy coinciding with a 5 kg weight gain – I can’t blame it on her – my ‘golosità for good food was more to blame!). She was also a great support for my wife and I when my son was born and came to live with us for a period to help out in the house and provide much needed help at a tough time for all new parents. I also had a few run-in’s with her, but nothing serious. All in the name of a good healthy relationship. As I said, she will be sorely missed.

But as always, when a family member dies we are left with a number of bureaucratic and administrative hurdles which need to be dealt with. In Nonna’s case, there are various bank accounts, US social security and ‘succession’ issues which now have to be worked through. Hopefully it won’t be too complicated as Nonna had very little left in her name when she died.

This is not always the case and in fact my experience is that the deceased tend to leave quite a lot more bureaucratic matters than perhaps they would have wanted to, and certainly than the remaining family members would have wished for. But, we can make some preparations, in life, for the ‘inevitable’ and leave the best parting ‘gift’ possible for the remaining family members.

The following article is one which I wrote first back in April 2018 (https://spectrum-ifa.com/preparing-the-folder/) and since then I have shared it again on a few occasions. It seems appropriate to share it again with you now, especially since we are 4 years on since that date, we have all lived through Covid and faced with some interesting times ahead, so it would seem. (I have also made some updates to the original article to take account of changing technological developments). I hope you find it useful.

This type of article is never an easy one to write. Ensuring that your papers are in order in the event of your sudden death is incredibly important when living in another country. It will provide you with peace of mind that your loved ones will not have too much difficulty in administering your estate and your family will be eternally thankful that you did it for them.

The big problem is that as ‘stranieri’ we often have documents spread across multiple locations. The office, a house in another country, with family members and in that old box that no-one dares look in – papers that look like they came from the Victorian age in alot of cases. But whose job will it be to track all those down?

The purpose of this article is to outline a proven way of organizing ‘THE’ folder to minimise problems in the event of your death.

So what is ‘THE’ folder?

It is a single file (digital or physical – preferably both) where you keep all of your important personal and financial information together. It allows easy access to these documents in the event that you’re no longer around to help. It is really important to have it in place especially where one family member takes the lead with the family finances (typically one member of the household tends to dominate over money matters, but with the advent of shared technologies it is becoming more common to find that 2 or more family members are involved in the household finances). This includes paying bills, managing accounts and storing documents.

Is it worth the effort?

Yes, yes yes and yes. A time of loss can be stressful enough without having to try and piece together the deceased’s financial affairs. This can be a really difficult time. Don’t underestimate the kind of favour you will be doing to the executors of your estate if you have one place with all your financial and legal documents in an easy to understand format. You may not be around to hear their appreciation, but I can tell you, from experience, it will be eternal.

However, preparing ‘THE’ folder is much more than avoiding stress; if you leave behind an administrative nightmare you could delay access to inheritors’ access to funds and potentially cost a small fortune in legal fees.

According to an Independent financial adviser website in the UK (unbiased.co.uk – what is the probate process) the average time for probate to get settled is between 9 months and a year. In the USA the average time is also about a year. I also spoke to someone recently who confirmed that in their case it took over 1 year to deal with their parents’ estate.

So which is best…..physical or digital?

This comes down to personal preference, but I would always recommend both. Whether you choose to have a digital folder with all these documents in or not, you should at the very least have your documents scanned in case of fire or theft, and quite often companies will now accept scanned copies of documents instead of hard copies, if they can be certified or electronically signed.

With a digital file you can give access to a trusted individual who can access it in the event of your death. (Remember they will also get access during your life, so ensure they are a ‘trusted’ individual) A google file, for example, can be updated over time and which you and a family member have shared access to. This file can then be stored on your main computer, in the cloud or on an external hard drive. You can use a physical folder to keep all the same information together.

For what it’s worth, I decided to do both when building mine because my wife prefers paper and so is happier with hard copies of everything. I prefer digital. I have also shared the digital folder with some trusted family members.

So what should go in ‘THE’ folder?

Birth, marriage and divorce

- Personal birth certificate

- Marriage licence

- Divorce papers

- Birth certificate / adoption papers for minor children

Life insurance and retirement

- Life insurance policy documents, including beneficiary nomination forms.

- Details of any employer death in service benefits

- Personal pension documents (including any beneficiary nomination forms)

- Occupational / Final Salary pension details

- Annuity documents

- Details of any entitlements to state pensions

Bank accounts

- List of bank account numbers with account numbers, login details and passwords

- Details of any credit cards

- Details of any safety deposit boxes

(see my comments on passwords below)

Assets

- Property, land and cemetery deeds

- Timeshare ownership

- Proof of loans made

- Vehicle ownership documents

- Stock certificates, brokerage accounts, investment platform details and online investment account details

- Details of holding of premium bonds, government bonds and investment bonds

- Partnership and corporate operating/ownership agreements ( incl offshore companies)

The issue of which documents to throw away and which to keep is a common one. I always suggesting keeping everything if you are unsure

and then once a year with your financial adviser or legal professional have a clear out and keep the file tidy.

Liabilities

- Mortgage details

- Proof of debts owned

Details of gifts

- Dates and amounts / values (potentially helpful when calculating inheritance tax liabilities

(A word of warning here! If your estate is likely to be subject to Italian succession law on your death. [This might mean that you have lived in Italy for 10 yrs + before your death, as an example], then any gifts which have not been fully notarised may still make part of your overall estate and be subject to the provisions of forced Italian succession law. i.e the donee may have to give the money back and it be distributed between the rightful heirs according to Italian law, ‘should’ the beneficiaries request the funds.

Notarising gifts would normally need to be done where the benefits outweigh the costs of the action itself.

(Bear in mind that you will need to pay the notary costs of approx 5% on the value of the gift, plus any taxes and one off fees for the gift)

Income sources

- Making a list of all your sources of income, especially the ones which your family may not know about

Employer details

- A copy of your most recent tax return or accounts

Monthly expenses (so they can be continued after death or accounts closed)

- Utilities

- Insurance

- Rent / mortgage

- Loans

- Subscriptions / membership details

Email and social media account details

Essentials

- Wills / Testaments + details of the legal firm that helped create it, if relevant

- Instruction letter

- Trust documents

- Burial / Cremation wishes

- A copy of a living will, should you have ‘end of life’ instructions that you want medical professionals to be aware of should you be unable to communicate these due to severe illness or disability

Contact details

- List of names and contacts numbers for: financial adviser, doctor, lawyer/solicitor, accountant, insurance broker etc

How often should ‘THE’ folder be reviewed?

Firstly, it is sensible to note the date that it was last reviewed so that anyone using it has an idea of how up-to-date the details are.

Going forward, reviewing the file on an annual basis should be sufficient.

Online passwords

The issue of passwords has become infinitely more complicated in recent years because everything we access these days requires a password and it would be a full time job to document these and then keep them updated every time that one needed changing. There are now various Password Manager applications that you can buy to securely hold all your passwords. You can find some of the best HERE. However, if you are reluctant to use technology, which let’s face it could be hacked, then you are left needing to log all those passwords the old way…..writing them down!

And finally…

Be sure to tell someone about it. There is little point going to the effort of creating such a folder if know one knows of its existence or where to find it.

If you need help with putting your folder together or are unsure where to start then you can contact me for help on

gareth.horsfall@spectrum-ifa.com

or on my cell at +39 333 649 2356

Living in Italy

By Spectrum IFA

This article is published on: 24th September 2022

Italy’s parliamentary election 2022

I thought I would start this newsletter with a story of a recent trip to the market in Rome. As you will know, if you read this E-zine regularly, I go to the Mercato Trionfale for the weekly food shop. I like the experience, colours, sounds and chats in the market. I find that you also get a good idea of what is on people’s minds and how people are thinking in any moment. Obviously, the talk of the moment is not the Queen’s death (you may or may not be surprised to hear this) but of the upcoming elections in Italy. Both events are significant for women. Obviously, the Queen’s funeral is important because she seemed to be the glue that held the royal family and the Commonwealth together and we shall see how King Charles III gets on with that responsibility. Also, an equally important event is likely to be the election of Giorgia Meloni as first female prime minister of Italy.

Giorgia Meloni, for those of you in the know, is the leader of the Fratelli d’Italia party and is considered right wing. She is leading the polls with about 25% of the vote. Closely followed by the Partito Democratico (leftwing) with approx 21% of the vote. However, as is always the case in Italy, the parties need to form a coalition with smaller parties to gain a voting majority. Fratelli d’Italia have already announced their right-wing coalition with both la Lega (Salvini) and Forza Italia (Berlusconi). Together it is expected that they will garner about approx 45% of the vote. That is essentially a landslide in Italian politics and it is almost certain at this point that the ‘centrodestra’ coalition will be taking power shortly after the vote on 25th September.

The big worry for many is that Giorgia Meloni and Fratelli d’Italia have their roots planted in a fascist past and the feeling is that their policies will start to unravel years of democratic advancement in the name of equal rights and protection for women (which in Italy are still lacking in some many areas), gay rights, abortion rights etc. It was with all this in mind that I decided to follow Giorgia Meloni and Matteo Salvini on facebook this summer. To be honest, what I read wasn’t significantly alarming and to be fair to Giorgia Meloni she has dealt with all criticisms head on and opening encouraged discussion with her opposition, rather than just slurring them for being different. One particular instance was where someone got onto a stage when she was holding a rally and started a protest against her views on gay rights. She kindly invited the person to take the stage with her and explain their position so she could defend her own. Now, don’t get me wrong, I am no fan of Giorgia Meloni or any other right wing party in Italy but I would like to see more of this type of open discussion of differences of opinion and critical thinking rather than one side just spewing venom at the other because they have opposing views. Anyway, for someone who is a first-time voter in Italy (I gained citizenship in 2019 and so this is my first opportunity to vote in Italy) it has been an interesting journey so far. However, one other thing that piqued my interest, and I thought I would share with you here, is the centrodestra proposals to introduce a flat tax.

But, before I go into that, I will take you back to Mercato Trionfale for a moment. I wanted to tell you about the fact that I buy my eggs from the same stall, where oddly enough, he ONLY sells eggs! For as long as I have been going there (6 years) the eggs have been 35c for a ‘bio’ egg. After I arrived back from the summer break he apologised and explained that he needed to raise his prices. Now they are 40c a ‘bio’ egg. My initial reaction was whoooahh, an almost 15% increase in the price. But then I started to reflect on this whole inflation debate we have at the moment.

Quick thoughts on inflation

Obviously, prices’ rises are having a pretty big impact on our lives right now, and I don’t know about you, but I am anxiously awaiting my winter fuel bills this year. That aside, I was thinking that in the 6 years I have been buying eggs, this vendor has not increased his prices, not one cent.

In the financial planning world when I am looking at clients’ long term planning we always use a general rule of thumb of 3% inflation each year. Where do we get this figure from? Long term studies of inflation! Economists have looked at inflation over very long periods of time and established that bouts of inflation arrive in short periods, followed by periods of stable prices. If we think about the egg vendor and that he hasn’t increased his prices in 6 years, if he had done so using the 3% rule, then the price of his eggs should be more like 18% higher today than they were 6 years ago. This puts his 15% into context. Maybe we are not all that far off where we should be anyway. It’s just that when it arrives as a tsunami rather than a serious of small waves it tends to hurt a lot more.

My point is that prices’ rises are normal, and we have lived through an extended period of stability and low prices. With the significant debt creation events of the last 15 years (financial crisis 2008/2009 and more recently Covid), it is to be expected that inflation would return at least for a period of time, and even maybe rebalance to its long-term historic norm.

Flat Tax

OK, enough about inflation because I am sure that you are about as bored of hearing about it as I am. Important as it is, it doesn’t need ramming down our throats at every turn.

The talk of a flat tax rate of 15% has mainly been lauded by La Lega and Matteo Salvini; whilst the other parties have similar talk of flat taxes, there are some differences in the parties’ proposals. Let’s have a quick look at them here:

LA LEGA: A simple flat tax of 15% on all incomes. It has been calculated that this would blow a hole of approximately €50 billion euros in Italy’s public finances. Also, it is a highly unfair way of taxing people. Someone earning millions could get a 15% tax rate, in addition to someone earning €15000 a year. Clearly unequitable and favourable to the wealthier elements of society, not something I ever see coming to fruition.

FORZA ITALIA: A simple flat tax of 23% (equal to the lowest current band of income tax rates). It’s pretty much the same story as above, but instead would only blow a hole of €30 billion in the public purse!!

FRATELLI D’ITALIA: Their proposals, in my opinion, seem more do-able. Firstly, there is talk of introducing a ‘no-tax area’, which in other words would be a tax allowance on the first €120000 on income, extended to everyone. This would essentially model the UK style of taxation and is a model that I prefer. It favours the poorest in society and is a fair approach, in my opinion. However, that would come with a potential cleaning of the current system of detractions and deductions for medical expenses, vet’s bills etc. Who knows if the current system of bonuses for various home improvements will also be stripped back?

In addition, the idea is to a) (try not to laugh at this please) introduce an incremental flat tax system which will start at 15% (I have no idea what the difference is between progressive tax rates and incremental flat tax rates, but it sounds good) and then over time work towards a suitable flat tax rate, and b) tax income from properties and other financial assets at that flat tax rate of income tax .

Lastly, anyone who is currently working through a partita IVA ‘regime forfettario’ and is currently taxed at 15% up to income of €60000 pa, will have that ceiling raised to €100,000 pa.

There’s more!

Things do not stop there! One other interesting development is that according to an estimate in an article by Il Sole24Ore, Italians and Italian resident individuals have approx. €100 billion in assets and cash hidden in security boxes, either in Italy or abroad. I am not sure exactly how they come to this estimate and it certainly seems a large figure. The ‘centrodestra’ also sees this as another opportunity to try and bring these assets/cash home.

The proposal here is not a ‘condono’ (a kind of write off of any previous tax liabilities for a one-off tax payment, as it has been used frequently in the past), but to reduce the taxes on assets/cash by 50% for a fixed time period, to allow people to repatriate their funds and in addition apply a sanction of just 5% on the amount. This could be quite an interesting idea and for a number of foreigners living in Italy who have still not regularised their financial affairs, it could be an opportunity to do so rather than using the current system of fines and penalties that are significantly higher. The prevailing argument from the other side is that if someone is not ‘in regola’ with their financial affairs in Italy, then no financial benefit should be offered. However, rather than spending years of taxpayers’ money trying to find these hidden assets and cash, is it better to offer an opportunity to regularise them for a one-off payment? Who knows? The important thing is to get the money under the watchful eye of the Agenzia delle Entrate, no matter how you go about it, or at least goes the logic.

Let’s just start admitting the reality

I think it’s OK to start talking about the fact that the ‘centrodestra’ coalition are going to be governing Italy very shortly, so we can watch and wait to see what happens. Firstly, we can wait and see whether the International financial markets will approve of this government, (I suspect they will not blink an eye in the face of bigger issues around the world). Secondly, whether the EU will start their hardball tactics with a coalition that are inherently EU sceptic and teetering on the edge of advocating an Italexit (even if that is unlikely due to the constitutional requirements of just arriving at a Referendum).

Whatever happens next, there are going to be changes afoot in Italy, and you never know, some might even be for the better. Only time will tell.

Responsible investing and ESG

By Andrew Lawford

This article is published on: 12th July 2022

Why things really aren’t that bad

It might seem rather strange for me to be writing an article with this title given everything that is currently going on in the world. In truth, however, I have been vaguely working on this for some months, and whilst in no way am I trying to downplay the difficult situation in Eastern Europe, I have no particular insights to share on the topic (apart from wishing that calmer heads will soon prevail), and I am quite sure everyone is receiving enough information about it already.

We have a natural tendency to focus on bad news for the simple reason that no newspaper ever appeared with the title: “Everything’s going well – not so much to report today”. This is not strictly true – the website Future Crunch offers a periodic newsletter dedicated to good news. It is the perfect complement to the diet of negativity that we receive from traditional news outlets.

I had assumed that I was fairly knowledgeable about the world around me and had an objective view of humanity’s current state of affairs. I was thoroughly disabused of this notion by Factfulness by Hans Rosling, one of the most eye-opening books I have ever read and which I thoroughly recommend to everyone.

However, if you have little time or inclination for reading, you can take the Gap Minder test here, which is based on the work done by Rosling. It won’t take long and I suggest you do it before reading the rest of this article.

So what is my point? We tend not to realise that improvements are so gradual as to be imperceptible to us, and this, combined with the fact that we don’t often receive information that challenges our negative stereotypes, leads to a bias towards negativity. It is interesting how much bad news is anecdotal and how much good news is statistical – but of course you wouldn’t want it to be the other way around!

Is a negative bias worthwhile as we consider challenges such as climate change? I don’t know, but I would say this: panic is not a strategy, and going from bad to slightly better (whilst creating incentives to improve continually) is something we should celebrate. This reflection is also relevant to the field of investments: almost all investment houses now make ESG (Environment, Social & Governance) considerations part of their “process”. Are these processes perfect? Certainly not, but it is a start, and some of the leaders are blazing a trail that others are bound to follow. Again, from bad to not-so-bad is still something to celebrate.

In Italy, it is easy to complain about the bureaucracy, but I have to admit that some things are getting better. For anyone doubting this, consider the advent of SPID (Sistema Pubblico di Identità Digitale), which acts basically as a digital gateway to any interaction with the public administration. It is a Substantial Headache to get set-up (capital letters intended), but once you have it working, it is very useful. Also, consider PEC (Posta Elettronica Certificata) – a sort of “registered e-mail”. For anyone who has spent time and money sending raccomandate from their local post office – and let’s face it, you haven’t really lived in Italy until you’ve had to send a raccomandata, you really should invest in a PEC. For 10 euros or so a year you can send as many digital raccomandate as you like from the comfort of your own home, and they have the same legal validity as their paper counterparts. All companies and state entities have to have a PEC, so they are a very effective way of making official communications.

Of course, this technological advancement has also been a way for the Agenzia to concentrate its tax-collecting efforts. They are no longer in the dark about your assets abroad, thanks to the mechanisms of CRS (Common Reporting Standards). Most people have now come to terms with this and are making the necessary declarations. If you or someone you know have been sitting on the fence – talk to me about the best way of sorting out your situation – the key being that you should do this before you receive any requests for clarification.

There are also a number of tax incentives that have been launched in recent years, favouring pensioners, digital nomads and even very wealthy people. I took the opportunity recently to speak to tax practitioner Judith Ruddock from Studio Del Gaizo Picchioni about a number of them (as well as other matters of interest for Italian residents) and have published a podcast which you can find on Apple Podcasts, Spotify, Google Podcasts or Stitcher.

Please also check out my other podcasts, available on

Spotify, Google Podcasts, Apple Podcasts and Stitcher.

Italian financial update

By Gareth Horsfall

This article is published on: 1st February 2022

Well, well, what a start to the year – it feels like a repeat of winter 2021. As I write I am actually down with Covid again. I first got it in March 2020, right at the start of the pandemic and I have it again now. It is nothing more than a dry throat, cold like symptoms and feeling quite tired, but still it’s a bit annoying to have caught it again, although I think that given the transmissibility of Omicron it was a question of ‘when’ rather than ‘if’ I would get it. Anyway, I am now on day six and feel much better. However, I have just learned that since I only tested positive on day three of my illness, I now have to do another seven days quarantine before I will get the green pass……aaahhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhhh.

Anyway, I wasn’t writing to update you on my health, but actually to update you on the health of the financial markets at the moment and provide you with some tax updates.

For anyone who has been brave enough to look at their investment portfolio account balance in the last few weeks, you will have noticed that it has probably taken a turn for the worse. I am not talking crash-like turn for the worse, (remember March/April 2020!) but merely correction territory.

In short, equity markets have started to pull back from their highs in 2020 and 2021. I can’t say for sure when the correction will end, but from the information that I have been reading from various asset managers in the last few days there is confidence that markets will rebound in the first half of this year.

It is important to remember that corrections of this magnitude happen in more years than they don’t and rarely prevent equity markets from delivering positive returns during the year!

So what is going on?

Covid related supply problems for goods and services are the biggest concern right now, which is feeding into consumer prices: inflation (microchips, freight and energy are the biggest contributors). I have written about this in a previous E-zine and so won’t delve into too much detail here, but inflation is likely to play a big part in discussions around financial markets in the first half of this year, even though most economic indicators are predicting a quick return to form for the second half of the year.

One of the most important points is that with rising inflation, the central banks (mainly the Fed in the USA) do not start tightening monetary policy too quickly or harshly. There is no indication that they will take extreme measures in this regard and so companies will still have access to capital and will be able to invest. As long as company profits continue to grow and inflation does not start to spiral out of control then there should be a rebound, probably in the first half of the year.

Of course various themes will also continue to play out during the course of the year, namely: cloud computing, green buildings and construction and digital health and wellbeing. This provides us with well needed diversification in our portfolios. Big tech and smaller disrupting companies across many more sectors will play a big part in returns.

Inflation will likely cause some collateral damage along the way. Depending on how fast and high it moves, the biggest sector to be affected could be the residential housing market. It might cause a cooling down of the price rises we have seen in recent years, or may have a more long term and severe impact. A lot of that depends on whether this bout of inflation is ‘temporary’, and caused merely by Covid issues, or is ‘structural’ which means that it will be more bedded in for a long time.

Most of the information I am getting from money managers is that it will be temporary and that things will return to normal much quicker than we expect (think a couple of years!), but I am not so sure. I think it may run a little longer. But regardless of who is right, we need to protect the money that we have. There are plenty of excellent investment opportunities out there whether we are living in an inflationary or non-inflationary environment. The money managers we work with are on top of these and we can rely on them to seek out those returns where possible.

If you are a client then all you need to know is that we have been planning for inflationary rises for some time and so despite the current correction in investment markets, you really have nothing to worry about.

Tax matters – ‘residenza‘

During my Covid days sat at home in front of the computer, I receive a lot of pop-ups from various fiscal websites and from Sole24Ore (the Italian version of the Financial Times).

One that caught my eye the other day was an amendment to decreto Dl 146/2021, which clarified the fiscal treatment of the ‘family nucleus’ (nucleo familiare) who have established their residence (residenza) in two separate comuni.

The crux of this is that the courts ruled that two family members ‘cannot’ establish their residenze and claim 2 x prima case in the same nor different comuni.

This would seem to be a simple case of trying to avoid paying IMU on second (or third etc) properties. But the new law decreed that it would no longer be possible where members of the same family are living under the same roof. Apparently the law had not been clear enough…. until now.

I am mentioning this change in the law because it also has implications for people who may be registered in Italy as resident but may have a spouse who is claiming residency in another country. In my experience, the main reason for this is to try to save tax and whilst there may be some logic to it, where one member of the couple is working for a foreign company and maybe travelling to and from Italy rather than being permanently based here, it does still raise the question of how the fiscal authorities view the idea of the ‘nucleo familiare’ and what impact this has on our tax liabilities and where they lie. If spouses are registered as living in different places then there is some legal implication of separation and to benefit from any tax breaks, separation must be legally registered somewhere! If not, then the tax authorities will generally consider you as one family living under the same roof, hence both resident in Italy.

It raises some interesting questions, but might be a useful discussion point with your commercialista if you think you might fall into that net.

Fiscal treatment of Bitcoin

More and more people I meet are starting to dabble with the idea of buying some Bitcoin to add to their portfolio. I have been an investor for a few years, but my experience is not particularly a great one. It tends to go through phases of stratospheric prices rises and then complete collapse. As things currently stand I don’t see much value in the application of the buy and hold investment philosophy in relation to Bitcoin. It would appear to be something for the active trader, and then we are getting into speculative territory!

Anyway, the point of this article is to help you understand the fiscal treatment of Bitcoin in Italy, and to remind you that you will need to declare it in your tax return.

To understand the correct application for tax purposes, we need to remember that it is actually a currency and can be traded in much the same way as any other currency. In fact, since it is a registered currency (through the blockchain) then the Italian tax authorities treat it like any other bank account you might have. Hence, the tax treatment falls into that very simple law of €34.20 ‘bollo’ on any account that has an average annual balance of more than €5,000 in any tax year (less than €5,000, it does not need to be declared).

However, living in Italy would not be the same without some complications. This brings us back to the article that I wrote back in April 2021 on the same issue. Where you hold the value of Bitcoin (or any other currency) of more than €51,645.69 for a period of more than 7 days, any transfers of that currency into another from the 8th day would be considered speculative and capital gains tax would have to be calculated.

I wrote a long article on this subject, which you can read about here: spectrum-ifa.com/do-you-have-non-euro-based-cash-deposits/

For other questions, please contact me via the form below:

How do I deal with inflation?

By Andrew Lawford

This article is published on: 18th January 2022

“The only function of economic forecasting is to make astrology respectable”

JK Galbraith

This opening quotation might seem somewhat defeatist. Surely economic forecasting, given the importance of the economy’s performance on our investments, must be necessary. The problem is that in order to have a useful piece of information, that information must be both important and knowable. There is no doubting that the economy’s future performance is important information for us investors, but to what extent can we know it?

At the risk of using excessive quotations, there is a good story from Kenneth Arrow, who subsequently won a Nobel Prize in Economics in 1972, about his time analysing long-range weather forecasts in World War II. He came to the conclusion that there was no difference between the forecasts and pure chance, and communicated this finding to his superiors. The following is the memorable reply that he received: “The Commanding General is well aware that the forecasts are no good. However, he needs them for planning purposes.”

Which leads me on to inflation, without a doubt the economic piatto del giorno being served up in all current market analyses. Following a 2020 – 2021 in which it was decided, essentially on a global basis, to close down pretty much every non-essential activity and subsequently to apply massive amounts of government stimulus in the hopes of starting things back up again, we are finding a large number of anomalous economic effects. I imagine many people will have their own stories to tell, but my particular one is this: my son got to the point where he needed a new bicycle, having outgrown his previous one. A couple of years ago, this would have been as easy as going down to the local bike shop, choosing the model and swiping my credit card. This time, however, the bike shop told me that they hadn’t had a delivery of new bikes in two months due to logistics problems. They were, however, very happy to take my son’s old bike, a buyer for which was found in a matter of hours.

There have been plenty of variations on this theme in recent times, and it would appear that the process of economic restarting, with its attendant logistics issues, has fed into the current levels of inflation that are being reported. However, it seems unwise to extrapolate one observable trend and conclude that there is some inevitability about inflation remaining at its current high levels. This is the essential problem with economics: modelling extremely complicated systems such as economies is all but impossible: there are simply too many factors to take into consideration and the interactions between them all are unclear.

Of course, if we are investing, then it does seem like we have to take a view on macroeconomics and position ourselves accordingly. Financial newspapers exist to provide daily analysis of current trends and allow various experts to opine about their future path. There is little downside for those prepared to make forecasts: if they happen to be right about some particularly important phenomenon, they can trumpet for all time how they called the event. Their many incorrect calls, on the other hand, will be studiously forgotten about. If we extend this reasoning to well-known hedge fund managers, those who appear to have the Midas touch, we find ourselves subject to what is known as “survivorship bias”: for the few investors with truly long-term records, there are many others who have fallen by the wayside and whose investing results have been lost in the mists of time. This gives us the impression that there are gurus out there who know exactly what is going on in the economy, but it doesn’t correspond to the hard reality of investment: most truly successful investors don’t have a strong view on macroeconomic trends, because they understand that they are unknowable and that any market timing decisions based on forecasts are fraught with difficulty.

So if we can’t divine what is going to happen in the economy, can we know anything that is of use for protecting and growing our investments over the long-term? It turns out that the most important thing for investors is the mere fact of remaining invested. JPMorgan has shown that over the period from 1999 – 2018, the average return on the S&P500 index, the most important aggregate of US shares, was 5.6% p.a. However, your return would have been a paltry 2% p.a. if you had missed the 10 best days of that period, and you wouldn’t have made any money at all if you had missed the 20 best days. Keep in mind that those returns were produced notwithstanding several gut-wrenching market moves associated with the tech bubble bursting in 2000 (which led to three years of negative returns) and the financial crisis of 2008. If we zoom out even further, the annual returns for the US stock market in the post-war period have been positive in about 70% of the years. Those are odds that you want to take.

I should add as a proviso to the above that you need to have invested intelligently, and by that I mean choosing quality asset managers that are worthy, long-term stewards of your capital and who put your interests as clients before their own. It should, of course, be a given that financial professionals put their clients’ interests first, but the various scandals over the years have shown that one can never be complacent in this regard. My job as financial adviser is to help you to choose quality investments and to make sure that you understand the basic tenets of investment and stay with it for the long-term. If you’d like to discuss your own situation further, please don’t hesitate to get in touch for a free initial consultation.

With all of the above, I don’t mean to diminish the importance of inflation, but we need to keep it in its proper context: this isn’t a problem that has suddenly come out of the woodwork! It has been there all along, working quietly in the background to chisel away at your wealth. The graph below shows the effect of different levels of inflation over a number of time periods.

It should be clear that even modest levels of inflation can prove very pernicious – taking the example of a 2% inflation rate over a 20 year period, you will find that prices have risen almost 50%, and so if your capacity for generating income hasn’t risen commensurately, you will find yourself dedicating ever more of your resources to the bare necessities, leaving you less money available for discretionary expenditure. We are told that we have lived through a couple of decades of very low inflation, but I distinctly remember the prices of milk, fuel and train travel (between where I live and Milan) when I arrived in Italy in 2004, and the inflation rate based on these basic goods and services is in the region of 2 – 3% p.a. over the period 2004 – present day (the official value is about 1.3% p.a.). There is no need to get into a debate about how inflation is calculated – I fully recognise that some goods (like consumer electronics) have improved and become cheaper over this period, but I buy fuel for my car far more frequently than I buy a smartphone.

The effects of inflation on your economic well being often become clear only after a long period of time, so the best idea is to work out a plan right from the start to make sure that your expenses are going to be sustainable in the long-term. Doing this can be quite difficult however, as you need to factor in variable investment returns, withdrawal rates and inflation in order to see how your plan is likely to play out. Investing for a positive real return (a real return is adjusted for the effects of inflation) over time relies on taking a long-term view and, as with choosing the right investments, my role as financial adviser is to help you understand all the variables and to find a sustainable path for the future. If you worry about inflation, then you are right to do so, but I can help you in finding ways to protect yourself from its worst effects.

Please also check out my latest podcast – dedicated to citizenship, visas and estate planning, available on Spotify, Google Podcasts, Apple Podcasts and Stitcher.

A Financial adviser in Italy

By Gareth Horsfall

This article is published on: 2nd January 2022

Being an adult in the financial services business

Immediately prior to joining The Spectrum IFA Group in 2010, I was in my 30th year and wanted to take a bold new direction in life. I was working for HSBC bank in Doncaster, Northern England, at the time, and thankfully the years there were good to me.

However, some things in life seem to change the way you think, permanently. My personal experience of this was during and after my international travels (backpacking ) in 1998/99, visiting S.E. Asia, Australasia and N. America. It was an experience that just wouldn’t leave me. After having grown up in England for the first 24 years of my life, where sunshine is a rare commodity, and then spending a year and a half in sunbaked, tropical and generally sunnier climes, on my return to England I set myself a goal: within 5 years I aimed to move abroad to a sunnier/warmer country.

During those 5 years after returning I had put my time to good use. I had retrained as a fully qualified UK financial adviser, worked on the front line of a bank call centre, worked as a sales agent for an insurance company and was a successful candidate for a financial planning manager role at HSBC bank.

But now, it was about 3 months before my self-imposed 5 year deadline and I still wasn’t anywhere near meeting my objective. Then, by pure luck, by word of mouth through some family connections (sounds very Italian!) I was approached by a local UK IFA firm (also in Doncaster) to be one of their advisers and to open up their first international office in Rome.

I can tell you that I didn’t need much convincing. It would be a commission only role, which was quite frightening as there would not be a fixed regular income. However, my urge to live somewhere warmer overcame everything and I jumped at the chance.

I had never been to Italy before, didn’t speak Italian and had no idea about the culture, quality or standard of life in the country. This was never more evident that in my first month of work in July 2004.

We were expected to dress to work, as we would in the UK, i.e. suit, shirt and tie. However, as anyone who has ever been to Rome in July will know, it is no place for a UK style heavy woollen suit, shirt and tie. In addition, I had to take public transport everywhere because I didn’t have the money to take taxis.

I still remember vividly the time when I was returning from an appointment with a 1km walk to the metro station. I was sweating so much that everyone was giving me a very wide berth. I assume that they just thought I was suffering from a deadly disease. This was my introduction to life in Italy. But I was also now experiencing the sun, beaches, mountains (I started skiing for the first time), countryside and not to forget the food! (I remember saying to my now wife when I first arrived in Italy that food was just fuel for me. That attitude soon changed when she served me my first mozzarella di bufala and introduced me to her family, who mainly originate from Southern Italy).

I lived the next 5 years in a kind of expat bubble, never making an attempt to learn the language and just focusing on my work with the same company, but at the same time becoming more disillusioned with what I saw as the future of the business and their ideas.

During those first 5 years I also split with my long term partner in the UK whom I owned a home with; never an easy thing to do. But, I also met my wife (Italian, but educated in the UK), got married in Ravello on the Amalfi coast and we tried to start a family.

Unfortunately, starting a family was not as easy as we would have liked. After a few years of trying we were told that the only route would be IVF and our hearts sank! It was a heart wrenching journey, but in the end we were lucky enough to be successful after only the second attempt (further attempts never brought more children our way) and we were blessed with a baby son.