Returns from bank savings accounts are at an all-time low, and savers are becoming increasingly frustrated. Interest rates in the western world are at extremely low levels, with the euro base rate at 0.75 percent. In the UK it is even lower, at 0.5 percent. While this helps some people, such as mortgage holders with tracker rates, savers are being punished as banks have continually cut the interest rates paid on savings accounts. Retirees drawing a pension, or looking to buy an annuity, have also been hit hard in this low-interest rate environment.

Low interest rates are here to stay

First, it doesn’t look like this will change for quite some time. The prevailing policy of central banks has been to increase money supply (quantitative easing), maintain liquidity in the banking system and keep interest rates low. Even a slight increase in the base rate over the next couple of years is unlikely to result in decent interest rates on savings.

Second, inflation is running at around 2 – 3 percent depending on which part of Europe you live in. It just feels like everything is getting more expensive, especially food and energy costs. The end result is that we are effectively losing money by leaving it in the bank.

Of course, we all need to leave some cash in the bank as our emergency fund (most financial planners would recommend around six months of income). But it is the ‘nest egg’ money (the savings that we don’t really need in the short-term) that we can do something about.

How can you get your nest egg working harder?

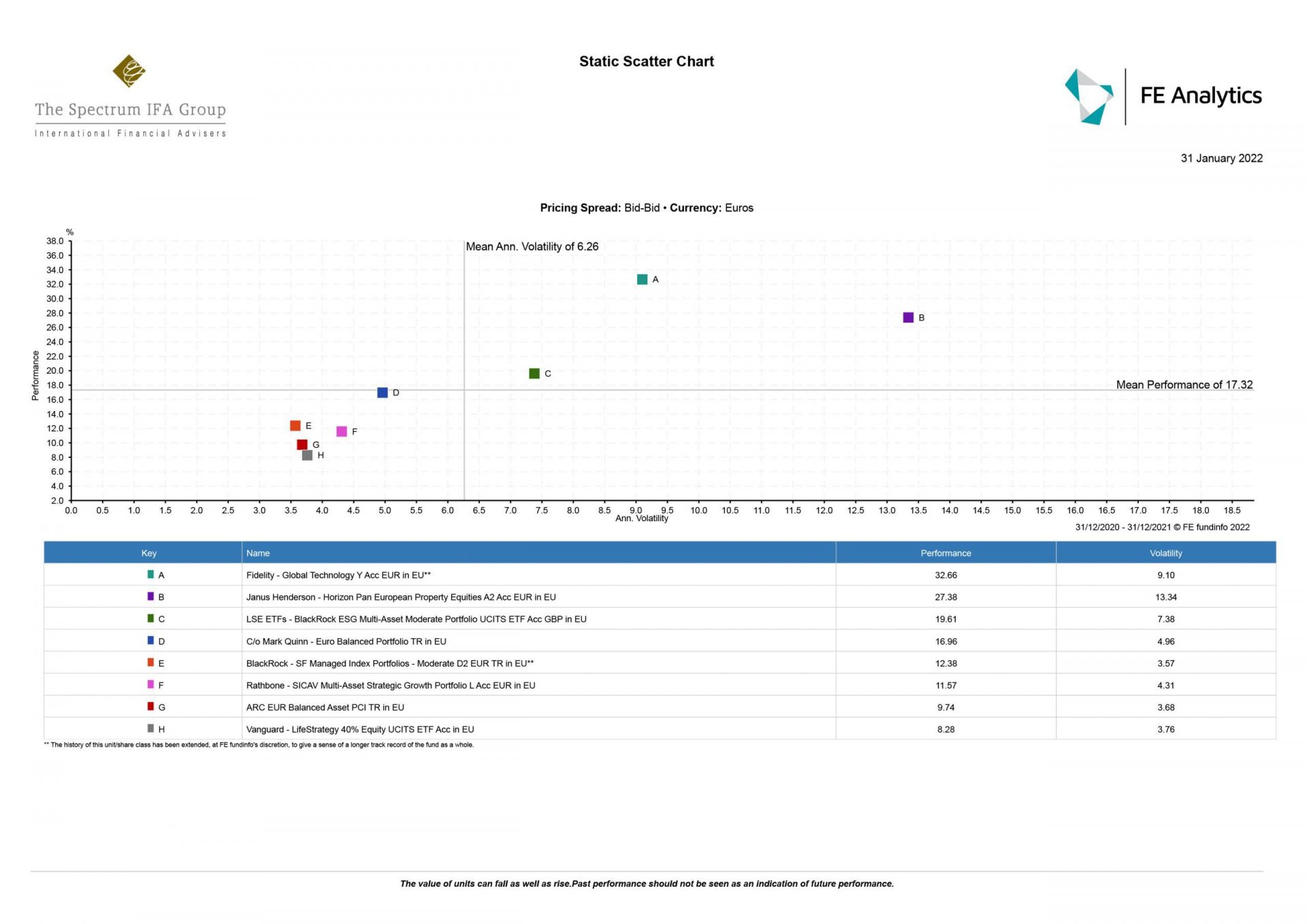

With the objective of ‘beating the bank’ over the longer-term, you can build a diversified portfolio of investments. In plain English this means spreading your money around and not having ‘all of your eggs in one basket’. Assets primarily fall into one of the following categories: equities (shares in companies), fixed-interest bonds, property, cash or commodities.

Lifestyle investing

You need to be clear about your ‘Risk Profile’. At Spectrum, we carry out a ‘Risk Profiler’ exercise which aims to establish the level of risk you are comfortable with and helps you understand the relationship between risk and reward. We then employ a forward-looking ‘Life-styling Process’ which means building a portfolio to match your own personal situation and objectives.

The eventual portfolio should therefore match your risk profile, usually measured from ‘cautious’ at the lower end of the scale, ‘balanced’ and then ‘adventurous’ at the higher end. The investment strategy should therefore be appropriate for your stage of life.

What assets to invest in

There are literally thousands of investment funds and vehicles to choose from. At Spectrum, we filter these by using strict criteria when choosing clients’ investments. For example we only use: UCITS compliant, EU regulated funds. This ensures maximum client protection and highest levels of reporting. Daily priced, liquid funds, so that clients do not get ‘locked-in’ to funds. Financially strong and secure investment houses. Funds which are highly rated by at least two independent research companies.

Multi-asset funds

Multi-asset funds are popular with clients as they are managed by experienced asset managers who, through active daily management, can offer access to all asset classes within a single fund. Their job is to capture capital growth while also protecting investors when markets suffer a downturn. Some fund managers have a great track record of doing this, for example Jupiter Asset Management’s Merlin International Balanced Portfolio, which has returned +34 percent (euro share class, as at end Feb 2012) since launch in late 2008, with relatively low volatility.

Multi-asset funds can be used as a ‘core’ holding within a portfolio, with more specialised and sector-focussed funds making up the rest of the portfolio.

Equities (shares)

Many blue-chip companies have very strong balance sheets and pay dividends of around 4 percent, which is higher than current interest rates. This dividend income can be re-invested into your capital (unless you need the income). The capital value of course will fluctuate but if you are investing for the longer-term you have time to ‘ride out’ any volatility.

Equity funds can be global in nature, regionally specific (for example focussing on emerging market countries) or even country specific. Other types of equity funds focus on smaller ‘growth-orientated’ companies rather than blue-chip, dividend paying stocks.

Ethical investing

Ethical funds are also an option. These are funds which only invest in ‘ethical’ companies. They are screened and assessed on criteria such as environment, military involvement or animal welfare.

Fixed-interest bonds

These include government bonds and corporate bonds. Western government bonds were traditionally seen as ‘safe havens‘, however yields are now currently as low as cash. You could consider corporate bonds, which are categorised in terms of risk (higher-yielding bonds means higher capital risk). Emerging market bond funds (with exposure to local currencies) could also be considered.

Many investors like to get exposure to bonds via a fund, which is a diversified mixture of bonds. One good option may be Kames Capital’s Strategic Bond Fund, with a return of +57 percent (euro share class, as at end Feb 2013) since launch in November 2007.

Commodities Commodity-focussed funds can be volatile and would normally make up only a small part of a portfolio. However there is potential for long-term growth by investing in companies with exposure to precious metals and resources (gold, silver, iron ore, copper) as well as other ‘soft’ commodities such as agricultural resources and the food sector.

Property

Collective property funds or property-related shares could also form a small part of your portfolio. Physical property by its nature is illiquid but by using a property fund you can obtain exposure to shares in property companies, keeping your money liquid.

Review your portfolio regularly

It is vitally important that your portfolio is regularly reviewed. One reason why people do not get the most from their finances is the lack of regular attention paid to their arrangements. Consider using a regulated, independent adviser who should offer regular reviews as part of their ongoing service.

At Spectrum we have an in-house Portfolio Management team, helping advisers and clients monitor client portfolios regularly for performance and suitability. One aspect of our regular reviews is ‘profit-take alerts’; when one area of your portfolio has out-performed, then why not take some profits? Investors can really benefit from such active management.