The Golden Visa scheme (est. 2011) was a residency-by-investment scheme, and whilst very attractive to individuals, has always been considered controversial by some Portuguese politicians as well as various EU governmental authorities.

End of the Golden Visa in Portugal

By Portugal team

This article is published on: 3rd March 2023

It allowed non-EU nationals to obtain residency rights in Portugal (and therefore access to the Schengen area) by making relatively low capital investments into real estate or Portuguese-based investments. It also had very loose minimum stay requirements of only seven days per year.

What happened?

As a result of the influx of foreign investment, mainly into the housing market, Portugal’s real estate sector exploded.

The increased demand for property has not only driven up property prices but also affected the rental market. Many of these properties have been made available for short-term lets e.g. AirBnB, because of the lucrative returns in comparison to long-term lets. In one of the poorest countries in Europe, where the minimum wage is just €760 per month (2023), it has led to a housing market crisis, pricing out many Portuguese nationals.

There have been efforts over the years to try and reduce the negative effect on the real estate market by restricting the qualifying investment locations, excluding the more popular coastal and city areas. But under increasing pressure, the Golden Visa scheme was terminated with immediate effect in February 2023. Premier Costa stated that it was, “no longer justified” and that it has served its purpose to inject much-needed investment into Portugal over the last decade.

What about those with the Golden Visa?

The Golden Visa is valid for five years. Those already in the scheme will only be able to renew their visa if they use the property as their own home or if they make it available for long-term lets.

No new Golden Visa applications will be accepted.

Other visa options

Despite the end of the Golden Visa scheme, many other options are available to prospective ex-pats. The most appropriate one for you will depend on your circumstances and intentions.

For example, a D7 visa requires applicants to have a minimum level of passive income and does not allow the individual to work in Portugal. The D2 visa is aimed at attracting entrepreneurs who wish to establish an economic activity in Portugal and will allow the individual to work. There are also visas aimed at digital nomads.

Buying a property in Portugal to acquire a Golden Visa?

By Mark Quinn

This article is published on: 23rd September 2022

Watch our recording of the recent ‘live’ seminar about investing in property in Portugal to aquire a Golden Visa;

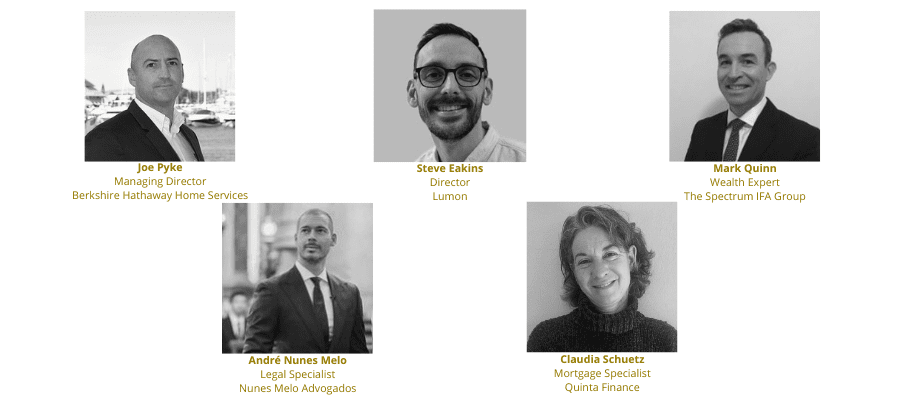

Our panel of experts discussed the parametres around applying for the Portuguese Golden Visa scheme.

Plus, the health care system, taxes, renting out your holiday home, insurance and currency exchange in addition to explaining the buying and selling process in Portugal.

Our knowledge and expertise in the marketplace will allow us to assist you with the application professionally from start to finish.

The panel:

🇵🇹Joe Pyke – Berkshire Hathaway Home Services for your property questions

🇵🇹Steve Eakins – Lumon for all your currency management questions

🇵🇹Mark Quinn BA ATT APFS – The Spectrum IFA Group for tax and investment questions

🇵🇹André Nunes Melo – Nunes Melo Advogados Law Firm for your legal questions including the golden visa

🇵🇹Claudia Schuets – Quinta Finance for all your Portugal mortgage questions

Live webinar – 22nd September – Golden Visa in Portugal

By Mark Quinn

This article is published on: 20th September 2022

Thinking of investing in your dream property in Portugal

to acquire a Golden Visa?

On the 22nd of September, our panel of experts will be able to answer your questions about the Portuguese Golden Visa scheme, the health care system, taxes, renting out your holiday home, insurance and currency exchange in addition to explaining the buying and selling process in Portugal.

Our knowledge and expertise in the marketplace will allow us to assist you with the application professionally from start to finish.

Spaces are limited so please register your interest now

to avoid disappointment.

Please feel free to submit any questions or topics you would like to see discussed so that we can make these events as interesting and useful as possible for you.

Your expert panel:

🇵🇹Joe Pyke – Berkshire Hathaway Home Services for your property questions

🇵🇹Steve Eakins – Lumon for all your currency management questions

🇵🇹Mark Quinn BA ATT APFS – The Spectrum IFA Group for tax and investment questions

🇵🇹André Nunes Melo – Nunes Melo Advogados Law Firm for your legal questions including the golden visa

🇵🇹Claudia Schuets – Quinta Finance for all your Portugal mortgage questions

Moving to Portugal | Visa Options

By Mark Quinn

This article is published on: 19th December 2021

Non-EU citizens, including the British post-Brexit, who wish to permanently settle in Portugal, must apply for a visa for the right to stay. EU citizens on the other hand have the right to freedom of movement and therefore have an automatic right to stay, so do not need to apply for a visa.

There are several visa options available in Portugal and the most common are the Golden Visa and the D7 visa.

Both visas allow access to the Schengen area, ultimate permanent residence or Portuguese citizenship, and a gateway into the Non Habitual Residence (NHR) tax scheme.

The key difference between the two programs comes down to one of cost versus flexibility. The D7 visa is clearly a lower cost route to Portuguese residency, both in terms of the fees and that there is no investment requirement as for the Golden Visa. However, the D7 route does have substantially longer minimum stay requirements.

Tax dimension

Whilst both visa options grant you legal residency in Portugal, one key difference with the D7 is that it automatically triggers tax residence status in Portugal. This may in fact be a positive thing for many people, given the existence of the NHR program which can result in substantial tax savings.

Whichever route you chose, please ensure you are implementing planning both before your move and after you have established Portuguese tax residency, and put in place planning now that will still be effective after the end of the NHR period.

We can analyse your situation and help decide whether tax residency and NHR status in Portugal is obtainable and will benefit you.