Why invest in the financial markets when interest rates are so high?

This is the second part of an article about interest rates and their impact on the financial markets for 2024 and beyond. Click here to read the first part of this article.

By Philip Oxley

This article is published on: 27th March 2024

Why invest in the financial markets when interest rates are so high?

This is the second part of an article about interest rates and their impact on the financial markets for 2024 and beyond. Click here to read the first part of this article.

My article a couple of weeks ago focussed on what has happened over the past couple of years in relation to inflation and interest rates and what is likely to take place next. This article focuses on what all this means for savings and investments. In addition, it will address a key question that was asked of me several times last year – when interest rates are so high and it is possible to obtain a healthy risk-free return, why invest in the roller-coaster that is the financial markets?

Risk & Return

By their very nature, there is always some risk when investing in the financial markets, although it is possible to calibrate a portfolio by the level of risk acceptable to the client. However, over the long term, the risk of your cash diminishing in value is much higher if you leave it in the bank. Certainly, over shorter-term periods the markets can be volatile and at any one point it is possible that the value of your investment will be worth less than the initial value of your premium. This never feels like a good place.

This leads to the question, why take any risk now, when it is possible to benefit from a return of between 3-6% by leaving your money in the bank? Well, in the short term, that’s a reasonable point and especially if your risk profile is low – i.e. you prefer not to take risks with your money, even knowing that this approach is likely to result in a lower return on your funds – then certainly a case can be made for this, at least in the short term.

French Interest-Paying Bank Accounts

In France, the best risk-free returns are to be had utilising the Livret A (maximum deposit of €22,950) and Livret de Développement Durable et Solidaire (LDDS) accounts (maximum deposit of €12,000) which are both paying 3% interest currently, free of tax and social charges. It makes a great deal of sense to place funds in these accounts as they are instant access, and it is important to have funds that you can access easily.

For those on lower incomes, 5% interest can be obtained with a Livret d’Epargne Populaire (LEP), with the maximum amount that can be deposited being €10,000. You will need to provide a copy of last year’s tax return documents (the Avis) to demonstrate that your income level is below the required threshold. Currently this threshold is €22,419 for a one-part and €34,393 for a two-part household – further details in this link https://www.service-public.fr/particuliers/vosdroits/F2367

For those with more significant amounts of funds and/or whose risk profile is higher, these accounts are still well worth using for holding an emergency fund that is easy to access.

For those with bank accounts in the UK, the returns have been even higher, and it has been possible to obtain 5% or even 6% interest, which is certainly appealing.

Risks of Keeping Assets in Cash

However, there is a but – or several buts in fact:

a) If your cash is earning significantly more than 3% (the LEP excepted), the chances are that your funds are in a UK bank account (not French), and you will have to pay tax on this interest in France. Therefore, whatever rate of return you are receiving in the UK, needs to be reduced by nearly one third to arrive at an actual net return.

b) All market commentators believe we are now at peak interest rates – in both the UK and Eurozone – and the next move will be down. Bank rates have been at levels hitherto unseen in decades, but they will surely not remain at this level as we progress through 2024.

c) Benefiting from high interest rates can easily coincide with periods of strong financial market performance – i.e. whilst you are benefitting from one, you could be missing out on the other!

d) Investing in the financial markets has always provided a greater return than cash over the long term.

e) Returns from cash have always failed to keep up with inflation over the long-term.

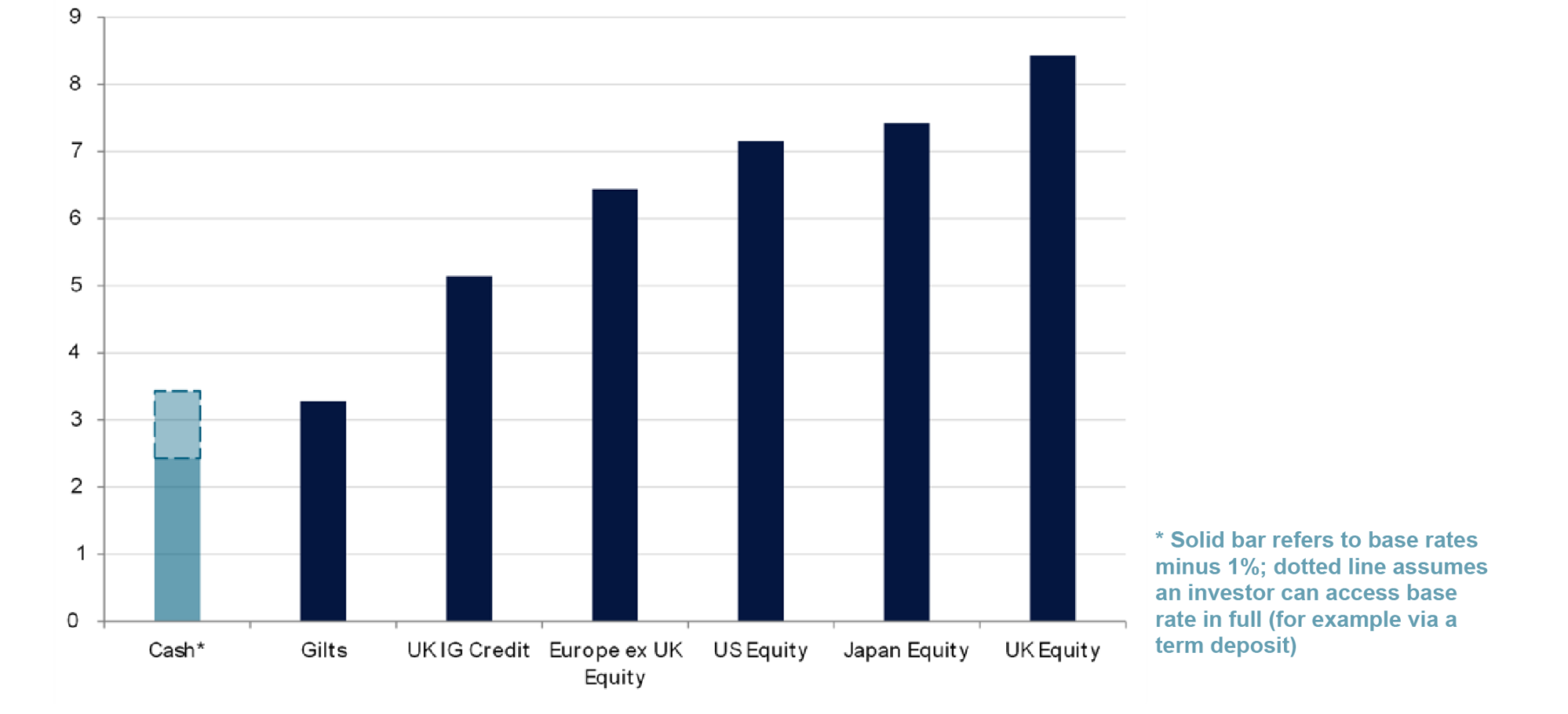

f) Rathbones, one of the UK’s leading investment managers, has forecasted that equities will return significantly more than cash over the forthcoming decade, see below:

We forecast that equities will return much more than cash over the next decade too

One of the best, short articles I have read in relation to the risks of keeping most or all your assets in cash is on Trustnet and quotes from Lindsay James, Investment Strategist at Quilter Investors. I enclose the link to the article below.

Sitting in cash ‘isn’t as risk free as investors think,’ warns Quilter | Trustnet

If you only look at the two graphs, this will illustrate the point clearly:

a) Graph No. 1: The first graph shows what happened to global financial markets in the year following the first interest rate cut (i.e. at the beginning of a rate cutting cycle). There are a few exceptions (most notably during the Global Financial Crisis in 2008/9), but in most cases the financial markets rose strongly. It is too late to wait until this happens and then move funds into the markets, as often the biggest returns can occur over the duration of just a few days, and this leads to the second graph.

b) Graph No. 2: This graph is even more stark, showing the investment returns over a 30-year period of an initial investment of £10,000. Staying invested throughout this period resulted in growth of 1020%. Being absent from the markets for just ten of the best days in the financial markets during this 30-year period, result in a return of half this amount, 469%!

This is why within the world of investing the following saying is so popular – “it’s not about timing the market, but about time in the market” or to put it another way, research has shown that those who remain invested in the markets through the troughs as well as the peaks, generally outperform those who try and time their buy and sell decisions to exit the markets as they fall and buy into the markets as they rise.

The reasons for this are that inevitably, people sell too late (i.e. the markets have already fallen which triggers their decision to exit), and then are too late with their entry back into the markets and miss out on significant gains. Even amongst professionals, it is usually luck not skill (or the benefit of hindsight!) which allows people to call the top or the bottom of the market or get remotely close.

In Summary

Those with limited savings and assets, who cannot afford to lock funds away for several years, should utilise the French interest-paying bank accounts I referred to earlier. Those who are very risk averse and find the prospect of seeing their investments fall in value, stressful and anxiety inducing, should also find the best return they can using risk-free savings accounts, but should also be aware that over the longer term, their savings will inevitably underperform market returns.

However, for everyone else, the evidence clearly demonstrates that investing in the financial markets, irrespective of potential economic or geo-political challenges and even with the current appeal of interest on cash deposits, will, almost without exception, deliver positive long-term financial rewards.

At the risk of oversimplifying – my advice to most people is to set aside sufficient cash for short term needs and unexpected contingencies and invest the rest in a portfolio that is appropriate to your risk profile.

Where should you consider investing any funds? That is for my next article where I will review the best options in France for tax efficient investing.

By Philip Oxley

This article is published on: 11th March 2024

What has happened, why, and what next.

Writing this at the beginning of 2024, interest rates around much of the developed world are higher than we have known for many years, in fact for decades.

This is the first part of this article on the subject, where I will look back at events over the past couple of years and what we can expect to happen next. The second part of the article will focus on what this all means in relation to the world of savings and investments, particularly when interest rates are higher than we have seen for decades.

Overview

Without delving too deeply into the world of macroeconomics, I think it is helpful to provide a brief overview of what has happened over the past couple of years in relation to inflation and interest rates and why. I will then look forward to what can we expect to take place over the next 6-12 months.

a) Interest rates – what has happened and why?

Central Bank Rate

In the UK, the Bank of England base interest rate is 5.25%. In the US, the Federal Reserve increased rates at a speed rarely seen before and rates are currently 5.5%. Finally in the Eurozone, the European Central Bank (ECB) rate, which is applicable in France, is 4.5%.

Outside of these areas, rates have increased in many other countries around the world (Japan is the notable exception, for now). In China rates are currently 3.45%, in India 6.5%, Russia 16% and Türkiye 45%.

Why have interest rates increased?

In a word, inflation. UK’s inflation rate peaked last year at 11.1% and you need to go back to the 1980’s to find a time when inflation reached higher levels. In France, inflation peaked at 6.3% last year and in the US at 9.1%, and again these rates were last reached in both countries back in the 1980s.

Who is responsible for controlling inflation?

It is the primary mandate of both the Bank of England’s Monetary Policy Committee (MPC) in the UK and the Eurozone’s ECB’s monetary policy to maintain price stability. For the MPC it is to “set monetary policy to achieve the Government’s target of keeping inflation at 2%” and the ECB it is “by aiming for 2% inflation over the medium term”. The equivalent body in the US is the Federal Reserve and interestingly, they have a dual mandate, which is to “achieve maximum employment and keep prices stable.”

I do not think it is too controversial to state that all three have failed to some extent in their primary objective over the past 18 months. Although in the US, employment levels have remained impressively high, so we should give the US Federal Reserve some credit for that.

How do you reduce inflation?

There are various tools and theories in relation to the control of inflation, including controlling the money supply (from where the phrase “monetarism”, commonly used during Mrs Thatcher’s time in power comes), Quantitative Tightening (QT) which is essentially rolling back and reversing years of Quantitative Easing (QE) that the central banks employed both after the Global Financial Crisis in 2008/9 and again during the Covid pandemic to boost economies. However, the primary tool used by all central banks is interest rates.

How do interest rates reduce inflation?

Higher interest rates suck money out of the economy, dampening spending, and loans. For consumers, mortgages, loans, and credit cards cost more, leaving less money to spend, resulting in lowering demand and inhibiting price rises. In addition, people are encouraged not to spend but to save, as it becomes easier to obtain a return on savings. Again, this adds to the reduction in consumer spending and businesses need to respond by either cutting prices or reducing the level of increases thus facilitating lower inflation.

Usually, a period of increasing interest rates is followed by increasing unemployment as businesses struggling under higher costs and lower sales must find ways to cut costs (and for many businesses, labour costs are a sizeable proportion of their cost base). This increase in unemployment can have a dampening effect on wage increases (people are prepared to accept a job offer at a lower rate than hitherto before), again all feeding into a deflationary cycle. I say usually, because employment levels have remained impressively robust in the US, UK, and the Eurozone.

b) Interest rates – what next.

Current interest rates

It is always a foolhardy exercise to try and predict events in the financial markets, but there are enough signals now, that some events appear to be inevitable (although I am keeping my fingers crossed that I do not regret writing this!)

In the US, the last interest rate increase by the Federal Reserve was in July 2023, in the UK the last increase of interest rates, to 5.25%, was in August 2023 and the ECB’s last rate increase was last September. Those rates have remained at that level ever since.

Last year market analysts starting using phrases like “higher for longer” and that rates would follow the profile of Table Mountain (a flat-topped mountain in South Africa if you are not familiar with it) in their assessment of what would happen to interest rates in the future. Another way of saying that once rates hit their peak, they would stay at that level for some time – and this has proven to be true.

What next for interest rates

Market analysts are strongly predicting that 2024 will be a year when interest rates start to decline. The only aspect of this prediction that seems uncertain is when the cuts will begin. The consensus is from Spring/early Summer with the ECB and/or Federal Reserve perhaps being the first to start the cycle of rate cutting.

Why in this important?

All the central banks are treading a fine line – trying to balance on one hand, calibrating interest rates to ensure the elimination of high inflation and bring levels back to around 2% sustainably. On the other hand, if they keep rates high for too long, they risk pushing their economies into recession. It is too late for the Central Bank of England, as the UK is already technically in recession (two successive quarters of negative GDP growth), as is Japan. The Eurozone is also perilously close to recession, but it is currently believed that the US is likely to avoid recession.

It is also important because high interest rates impact businesses as well as consumers and typically the financial markets have responded positively to the start of a rate cutting cycle which among other items, will be discussed in the second part of this article.

By Philip Oxley

This article is published on: 21st April 2021

As 2021 progresses and hopes of a better year than the last increase, I thought I would write about a question that arises for me occasionally in social situations. From time to time, I am asked, “Why do I need a financial adviser?”, or sometimes it’s simply an assertion, “I don’t see the point of having a financial adviser”. My usual response is to give a brief overview of what I do, however, depending on the circumstances, I don’t always offer a thorough response and then subsequently regret not having taken the opportunity to fully outline the benefits offered from the work my peers and I do.

I appreciate that in terms of popularity and reputation, my industry is not at the top of the pile – sometimes being undermined by the disturbing stories of people being scammed (particularly in the field of pensions), and also a small minority of advisers who are exposed as either not qualified/licensed to operate, or who fail to act in the interests of their clients.

However, I know from the feedback that my colleagues and I receive from many of our clients that the work we do is appreciated and valued by many – sometimes for quite different reasons. So, I thought I would outline the benefits of why, if you do not currently have an adviser, you might want to consider exploring whether your finances could benefit from professional advice and ongoing support.

This list is not meant to be exhaustive and I have tried to avoid a generic list, instead drawing upon feedback and anecdotal evidence from individuals – some clients, some not…yet! Hopefully, my list provides a selection of reasons why I believe the work we do can be of significant value to many.

The fundamental purpose of my role is to help my clients save money, and to grow and protect the money they already have. Such savings can be made through lower fees, reduced currency exchange risk, tax-efficient investment structures, and ensuring the best pension scheme for the client is selected. These same actions can also have a positive effect on the growth and protection of a client’s money. By choosing the right investment, an impact can be made on reducing inheritance tax liability for loved ones. Furthermore, if the worst happens to you, by selecting the best pension structure, you can ensure that your loved ones can be beneficiaries of your entire pension, in accordance with your wishes.

Of the financial solutions that I can offer my clients, few (if any), are available through banks or insurance companies – schemes offered directly through these organisations are usually the company’s own in-house products. I am not suggesting that these options are not suitable, but the advantage of using a financial adviser is the breadth of choice and the ability to select the best available products that most accurately suit the individual. Also, whilst some financial products are available directly to the consumer, many are not and can only be provided in conjunction with professional advice.

Sometimes in life, it is nice to have someone to discuss important matters with. People often turn first to their spouse or partner, friends, and sometimes work colleagues. I often speak to people who believe that they have their financial affairs in good order, but they value having a professional and independent “financial health check” to confirm that they are on track, or to provide an objective perspective on some of the areas that might need some attention.

Let’s be honest, most people enjoy spending their money – whether it’s on their home (often, but not always, a good investment), clothes, food, entertainment, cars (virtually guaranteed to be money-losing, unless classic/vintage cars are your thing!), and holidays.

It is not always easy to take a portion of your regular income and set it aside for the medium to long term, and of course, not everyone has the luxury of having a surplus at the end of each month.

However, a good comprehensive financial review doesn’t just analyse your assets (e.g., pensions, investments, savings, property), and liabilities (e.g., mortgage, credit card debts, car, and business loans), but also reviews your income/expenditure and your long-term wants/needs, to help assess whether there is the capacity to save, and how much.

A good financial adviser will encourage you to think about the long term and help you to take the right steps towards financial security.

This is a response I occasionally hear, however, irrespective of financial situation – whether the individual’s money is invested in their business or home, or they live on a low income – I am always happy to conduct a financial review. I can usually share some valuable insights, even if the person does not subsequently become a client. Do not let these reasons put you off speaking to an adviser – my confidential financial reviews are free of charge, and there is no obligation to accept my advice (although, I am pleased to say, most people do!).

Many people associate financial advisers with pensions or investing/growing wealth. However, a crucial part of good financial planning is about protecting any wealth that you already have, and making contingency plans for all possible disruptive events that might come your way. When conducting a confidential financial review, I always ask if such matters have been considered, and whether arrangements are in place to provide financial protection in all eventualities. Life insurance is not always necessary, but a will is essential – I can put people in touch with English-speaking professionals in France who can assist in both these areas.

For those whose lives are extremely busy (I think many of us can relate to this category!), they simply do not have the time (and/or inclination – see point 9!) to look after their financial affairs. Often people know they should be devoting at least some attention to their long-term financial security, but just never seem to get around to taking action. Sometimes, these people are well-informed and know very clearly what their financial objectives are, but do not have time to implement their plans and would rather a professional undertake this work on their behalf.

In this area, the work we do is not just about advising individuals on the importance of saving for the future or selecting the best scheme for their individual needs.

For British nationals living in France who have private pension schemes in the UK, a proper analysis should be conducted to decide if it is best to leave their pension schemes where they are, move them to a UK-based SIPP, or possibly offshore into a QROPS. There is no one correct answer and I am not going to get into the detail of this now – it was the subject of my last article!

The second critical element of this work is to forecast what level of income someone will require in their retirement once other sources of income reduce or cease, and to then plan how that need will be met through rigorous financial planning.

Of course, this is one that I struggle to understand! I have a relative, who will remain anonymous, who encapsulates the example perfectly. This is someone who is financially comfortable, but genuinely finds the subject of savings/investments (or anything to do with managing their money), of absolutely no interest – to quote, “Boring”!

As long as their money is secure and providing some growth, then they will quite happily entrust as much of the decision making as possible to their financial adviser. The key to this working is to get to know the individual very well, understand their risk profile, and be clear on the circumstances of when they wish to, or must, be consulted on decisions.

The final reason to use a Financial Adviser (and I accept this is obvious, but I needed a tenth!), is for the knowledge and expertise they can offer on available products (relevant to the country in which they work). The good ones will ensure that they thoroughly understand their clients, establish solutions that align with the individual’s aspirations, risk profile, and ethical stance. It is important that your adviser is permanently based in France, works for a French company, and is properly licensed with the relevant regulatory authorities. Above all, make sure they are someone you feel a connection with, who understands you, and who you feel confident in establishing a long-term working relationship with to support your financial goals.

In conclusion, last year was incredibly challenging for many people – both financially and emotionally – and whilst some of the restrictions we have all lived within have eased, realistically, it will be some time before life resumes with some sense of normality. Whilst everyone’s health – physical and mental – must always take priority, I honestly believe that knowing that your money is protected and growing tax efficiently, and that you have taken the necessary steps towards your long-term financial security, is one less thing for you to worry about and makes a small but important contribution towards peace of mind.

By Philip Oxley

This article is published on: 12th October 2020

For British Nationals living in France, perhaps the primary decision to be made in relation to long term financial planning is whether or not to take any action with regards to any pension scheme/s they have in the UK.

To deal at the outset with one question I have seen asked, and increasingly so since the Brexit decision, it is important to state that it is not necessary to move your pension if you move to France. Even after Brexit, you will still have access to your pension funds. Concern that you will lose access to your pension fund is not a good reason to move it!

However, there can be good reasons to consider moving your pension once you have relocated to France. This decision should be made only on the basis of a proper analysis having been conducted on your existing schemes.

As a French resident, the primary options in relation to your pension scheme/s are as follows:

i) Leave them where they are

ii) Move them into a QROPS

iii) Move them into an International SIPP

iv) A combination of the above

Click on the sections below to find out more:

Following a professional review, sometimes our recommendation is to leave your pensions schemes in their existing arrangement in the UK. Reasons for doing this include the following:

One key drawback to this approach is that you will forever receive your pension in GBP, therefore always be subject to exchange rate risk and currency exchange costs. You only have to speak to someone who already receives their pension in GBP (or even read some of the posts on Facebook on this issue) to see that British Nationals have really felt exchange rate pain in recent years, only receiving €1.10 currently for each £ when once it was closer to €1.40. In addition, there is the time spent researching and using currency exchanges to try to obtain the best rate.

For example, drawing a pension of £10,000 per year and converting to Euro would have yielded approximately the following amounts over the past 15 years:

These fluctuations are not helpful in your later years when you need to plan your financial affairs and seek a degree of certainty in relation to your income.

A QROPS has been the go-to product for many expats over the years. To be classified as a QROPS the scheme must meet certain requirements, as defined by Her Majesty’s Revenue & Customs (HMRC). Amongst the key benefits are the following:

One disadvantage of some QROPS is the level of fees. Because of the structure of a QROPS requiring an offshore investment platform, EU based trustee (typically Malta-based) and sometimes a Discretionary Fund Manager (DFM), costs can in some cases become prohibitive. However, regardless of pension value, there is scope to control both initial and ongoing charges. With proper planning, cost should not be an obstacle to establishing a QROPS.

A SIPP has some of the advantages of a QROPS in relation to currency flexibility and consolidation, but because it remains a pension structure domiciled in the UK, the tax advantages in relation to the LTA and Death Benefits for heirs do not apply. Also, it remains exposed to any legislative changes made by the UK Government in future budgets.

However, if you plan to move back to the UK or prefer to keep your pension based in the UK, then this is an option that may be suitable.

What I mean by this, is that if you have a good, well-funded Defined Benefit (final salary) scheme and also one or more Defined Contribution (money purchase) pensions schemes, you have the option to move one or more into another structure (e.g. QROPS or International SIPP) and leave some of the schemes in place. For example, you may want to keep the security of a guaranteed pension that a Defined Benefit scheme provides but move your other DC pension schemes into a QROPS or SIPP and secure the benefits that ensue from these structures.

In deciding whether to go ahead and transfer your existing pensions into a different structure, typically the bar should be set at a higher level for a Defined Benefit (final salary) scheme. This type of pension provides a guaranteed income for life, offers some protection from inflation and the risk of funding your retirement does not rest with you (i.e. you are protected from the ups and downs of the stock market).

However, these schemes do lack flexibility and by exchanging the guaranteed annual income from retirement age, you receive instead a cash lump sum (and transfer values have seldom been higher than now) which you can invest and spend how you like with access from age 55 and the ability to pass the full amount onto your beneficiaries (tax-free if you die under the age of 75 and also the potential to be tax-free over the age of 75 if your pension is a QROPS).

Most Defined Benefit schemes only pay half of your pre-commutated pension to your spouse should you die, and usually a minimal amount or nothing to your children if you no longer have a spouse at the time of your death or your spouse who was a beneficiary of your pension subsequently dies. A QROPS for example allows much greater flexibility in relation to the selection of a beneficiary, allowing the funds to pass to any named beneficiary. Also Defined Benefit schemes are not entirely risk free – many are underfunded and some may be unable to meet their obligations (although the Pension Protection Fund exists to provide 90% of the guaranteed income if the scheme becomes insolvent before you reach retirement age, although there are maximum limits of compensation, i.e. £37,315 at age 65. The full amount would be paid if the scheme became insolvent if you were over the scheme retirement age).

a) Defined Benefit (or Final Salary)

• Provides guaranteed pension as a proportion of final salary based on i) salary ii) years of service iii) accrual rate (e.g. 1/60th of final salary for each full year of service)

• Payable from Age 65 (if taken earlier penalties apply for each year taken before 65)

• The pension is reduced when taking a lump sum

b) Defined Contribution (or Money Purchase)

• Pension benefits depend on the size of the fund

• Significant flexibility in relation to when to take the pension (currently from Age 55), how much to take and structure used to take the pension (annuity, capped and flexi-access drawdown, UFPLS, Scheme etc.)

• The pension fund size will depend on how and where it has been invested and the performance of those funds

This is a complex area and it is difficult to cover all relevant details within the parameters of this article. There are other considerations I have not addressed here, and this piece should be considered a high-level overview of some of the factors to consider. Perhaps the best advice I can give is the following:

A final point to consider is that there is currently a 25% tax applied to pension transfers into a QROPS for British Nationals living outside the EEA. After 31 December 2020, it is possible that this tax will also apply to those living in the EEA (as the UK will no longer be an EU country and the transition period will have expired). This has not yet been confirmed by the UK government but the opportunity to consider a QROPS as a financial planning option may not exist beyond the end of this year. If this is an option you want to explore, I recommend you do this without delay.

By Philip Oxley

This article is published on: 6th April 2020

What’s been happening?

It’s been a very turbulent period over the past few weeks as Coronavirus has taken hold and the impact on the financial markets has been almost unparalleled. Oil is now cheaper per litre than milk or bottled water due to an “oil war” between Russia and Saudi Arabia leading to an oversupply of oil in the markets. In addition, with fewer people on the roads and most airlines grounded, storage facilities are believed to be only months, possibly weeks away from full capacity. Some speculate that the price of oil could fall to zero! Those assets deemed to be “safe havens” such as gold have provided some refuge but it is still trading lower today than it was towards the end of February.

Most of the major financial markets experienced falls of c. 30% during the end of February and into March and whilst there has been some recovery, there remains much volatility and it’s not clear yet that the bottom of this dip has been reached.

Meanwhile, every day there is news of companies cutting or suspending dividend payments to shareholders and as I write this the UK’s major lenders have all agreed to scrap pay-outs to shareholders during 2020 (after receiving a strongly worded letter from the Prudential Regulation Authority). The banks are also being asked to scrap bonuses to their executives.

Why? Well, this should provide the banks with a much needed, extra £8bn cushion as they face increased demands to provide financial support to individuals and businesses in the form of loans, mortgage holidays etc.

What should you be doing?

For those who are close to retirement age, I cannot overstate the importance of speaking to your financial advisor during these challenging times. Essentially, the closer you are to needing to draw a pension or access your investments, the bigger the impact this drop in the markets will have for you.

For those of working age with a pension scheme or schemes and/or savings invested in the markets what actions can you take? Fund managers have been working hard to mitigate the extreme movements in the markets and protect the value of the funds they manage, but there is no escaping that a significant “correction” has taken place. For those of you brave enough to look at the value of your pension fund/s, most will be facing a reduction in value in the region of 10-25%.

It is impossible to say that there will not be further falls, however history has shown that pulling your money out now (where this is an option) or re-calibrating your portfolio by moving out of equities and into bonds, gold, cash etc. is rarely the best course of action. Typically, these decisions are taken too late (when many of the falls in value have already taken place) and re-entry into the markets is typically made too late (missing out on some of the gains that will have already taken place). The result of this is to lock in the losses that have taken place. Remember, these are only paper losses at this stage, albeit painful to bear – and it is only once you move out of the assets or remove cash that a loss will be realised. Whilst it takes a steely resolve and not a little anxiety, it is nearly always better to stay invested and ride out the storm.

It is certainly a good time to review the balance of your investments in your pension scheme or Assurance Vie to ensure they still match your risk profile. But be careful about disproportionately moving out of equities at this stage, as this may hinder the growth of your portfolio as the markets return to growth.

What next?

Markets will recover as they have always have (think 2008 Financial Crisis or “Black Monday” in 1987) – it’s simply a case of when and there could be more volatility over the coming months before we see this happen. There are some early signs of green shoots in Asian markets, for example, factory data from China showing a sharp step up in activity in March.

But the news from many European counties and the US is grim. Most developed nations, and many others besides, will experience a sharp and deep recession. The hope remains that the decline in growth will be “V” shaped as opposed to “U” shaped, meaning the recession will be short-lived and the recovery quick and significant. This is not guaranteed however, and the length of the downturn will depend on many factors, perhaps the greatest being the spread and extent of Coronavirus cases over the coming months and the speed and size of response from governments and central banks.

So, is it a good time to invest? Possibly, but with caution and perhaps a “drip-feed” rather than an “all-in” approach. And as always, it’s better to have a financial advisor working alongside you to provide professional guidance in these matters.

Finally

On a personal note, apart from when I am out meeting clients, most of the time I work from home – from the end of our dining room table which is in a quiet room during the day. I occasionally remind my teenage children to be quiet at the times they are at home, particularly if I am on the phone speaking with a client. Yesterday, my 13 year old son, stuck his head around the door and said, “Could you guys keep the noise down please?“ My wife and I were discussing the challenges of on-line food shopping and he was in the next room on a live streamed lesson, so his request was perfectly reasonable. But times have certainly changed!

The coming months are going to be very challenging for us all. We are seeing the consequences of Coronavirus both in terms of the restrictions we all have on our way of life and more devastatingly on the lives lost across so many countries. At this time, the overriding focus for us all must be on the welfare and safety of ourselves, family, friends and neighbours. In addition, on top of these concerns, many people will become stretched financially.

As the French-born Etienne de Grellet said, “I shall pass this way but once; any good that I can do or any kindness I can show to any human being; let me do it now”.