Comprehensive, personalised financial advice

Tax efficient investing – pensions and retirement planning – estate and succession planning –

mortgages – currency transfers – life assurance

We’ve got you covered

With 12 regional offices and 50 advisers operating in France, Spain, Portugal, Italy, Luxembourg, Malta and Switzerland, we have been building long term client relationships since our foundation in 2003.

Contact one of our locally based advisers for an outline of how we can help you.

Financial planning for expatriates across Europe

In today’s world of finance one thing is clear, we all have to pay attention to and take great care of our own finances. Spectrum advisers are here to help you, our clients, with the many complex financial and tax issues you are confronted with: retirement and pension planning including QROPS, Life Assurance, efficient investing (using Insurance wrappers), succession and inheritance tax planning, currency exchange and many more. As for most expatriates, these planning issues may exist in more than one country, and we believe working with experienced, qualified, cross border advisers who are themselves expatriates, and therefore facing similar challenges, is really important.

At Spectrum we believe clients should not leave their finances entirely in the hands of a third party, a banker, an investment manager or an adviser. We want our clients to stay involved and work with us to ensure they continue to prosper. We put an emphasis on continued financial advice and support with some of our clients having worked with their adviser for more than 15 years.

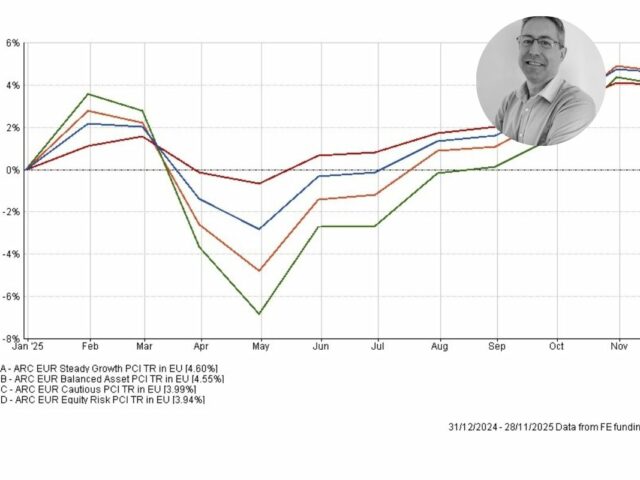

Our commitment to long term business relationships allows us to provide advice and reassurance during the inevitable changes in tax rules, movements in exchange rates and markets.