Recently announced changes to the non-domicile system in the UK could be extremely beneficial for Brits living in France.

British expats living in France may soon pay no UK inheritance tax

By Richard McCreery

This article is published on: 10th April 2024

The Chancellor of the Exchequer, Jeremy Hunt, said in his Budget speech in March that the government intends to reform the existing Inheritance Tax scheme which is based on domicile rather than residency. In legal terms, your domicile is considered to be the country to which you have the strongest ties and that is often simply due to the fact that you were born there.

Relinquishing your UK domicile is very difficult, even if you have lived outside of the country for many years. Domicile tends to be permanent, unlike residency for tax purposes which changes according to your home, your centre of interests and where you spend most of time throughout the year. The Teflon-like nature of domicile means that the UK can still apply its 40% rate of Inheritance Tax to your estate when you die and, at the same time, all your worldwide assets can fall into the scope of French inheritance tax if you live full-time in France.

However, from April 2025 this situation should change so that British expats in France will no longer be taxed in both countries if they have lived abroad for more than 10 years and they have no assets in the UK. The detail is not yet set in stone, but this is our current understanding of how the new rules will work. The changes might encourage some people to consider moving assets out of the UK in order to avoid any liability there, and the government knows this, so we’ll have to see the finalised details before we can judge how beneficial the changes really are. The prospect of a new party in government following this year’s general election also adds a further element of uncertainty about what the rules will eventually look like.

France also applies Inheritance Tax at rates that can be quite punishing in some circumstances. Beneficiaries can inherit a defined amount of money tax free, depending on their relationship to the deceased, but these allowances can be swallowed up quite quickly, especially where a property is included in the estate. Fortunately, France does provide residents with some very attractive ways to reduce any such tax bill and with the right advice an ordinary family can shelter hundreds of thousands of Euros from Inheritance Tax.

If you would like to discuss your family’s estate planning, or any other financial issues that are important to you, please get in touch to arrange a no-obligation meeting or conversation.

Financial update France – April 2024

By Katriona Murray-Platon

This article is published on: 4th April 2024

April is an important month of the year as, not only is it the end and beginning of the UK tax year but it is also the beginning of the French tax season.

If you are impatient to start declaring your income for 2023 then the tax forms should be available in the next week or so (at the time of writing no official date has been given) but whether you decide to get started in April or wait until May it is important to know the deadlines for submitting the forms.

If this is your first year submitting your tax return you will need to do a paper declaration by the 20th May 2024 (date to be confirmed). Which means that you need to collect the paper forms from the tax office and fill out the information by hand.

The other dates for the online tax declaration service are:

| Department | Filing deadline |

| 01 to 19 | Thursday 23 May 2024 at 23h59 |

| 20 to 54 (including 2A and 2B) | Thursday 30 May 2024 at 23h59 |

| 55 to 974/976 | Thursday 6 June 2024 at 23h59 |

| Non-residents | Thursday 23 May 2024 at 23h59 |

I shall be tackling our tax return in the April school holidays so in my next Ezine I shall be addressing any issues that I have noticed and be giving you all my tips for filing your 2023 income tax declaration.

Do you remember the fun you had last year doing the occupied properties declaration? Well, the good news is that you don’t have to do it every year! You only need to do another one if there are any changes to the occupancy of your properties. Whilst the declaration does have to be done online,18% of property owners did not do a declaration last year and the tax authorities shall be issuing a new paper declaration for those who are unable to do their declaration online.

Did you know that students do not pay taxe d’habitation on their student accommodation (CROUS)? However, a ministerial response in January (no 7826 of 09.01.2024) has clarified that this exemption also applies to students who are still included on their parents’ tax returns but who live away from their parents in private student accommodation or who flat share.

As from 1st April many benefits, including family allowance, disability allowance and RSA, will increase by 4.6%, as a measure to mitigate the effects of inflation.

Those of you who do furnished rental were quite alarmed by the French government’s “faux pas” in the 2024 finance bill which lowered the micro threshold to €15,000 and the abatement to 30% thus forcing those who were over this limit to go into the costs (regime reel) based system. As expected, this has now been rectified and landlords can use the former thresholds (€77,700 micro-BIC with a 50% abatement for costs – https://bofip.impots.gouv.fr/bofip/3610-PGP.html/identifiant%3DBOI-BIC-CHAMP-40-20-20240214). Hopefully all the organisation will have got the memo but if you do have any problems please do refer to the link above. As always, if I hear anything further on this I will let you know.

There are three pillars to the French pension scheme, the basic social security pension, the complementaire points based system and the private PERs. I strongly advise anyone who has worked in France to create their profiles on the www.info-retraite.fr website and to regularly consult this website especially when you are getting closer to retirement age. I noticed on my own account that whilst I had accumulated points as a salaried worker, since starting my business in 2017 I had not received any further points nor had I been asked to contribute to receive them. This has now all been cleared up by a decision of the Council of State on 9th February 2024 (no 471203) which nullified a decree that provided that auto-entrepreneurs under the micro-BNC regime and micro-social regime that pay a set rate of social contributions of 21.1% do not acquire points under the complementaire retirement scheme. A new law should be published soon rectifying this as from 1st June. This will however imply that the rate of social charges will increase.

If you have any questions on your finances or taxes in France please do get in touch and I would be happy to arrange a phone call or meeting to discuss your concerns.

Why invest?

By Philip Oxley

This article is published on: 27th March 2024

Why invest in the financial markets when interest rates are so high?

This is the second part of an article about interest rates and their impact on the financial markets for 2024 and beyond. Click here to read the first part of this article.

My article a couple of weeks ago focussed on what has happened over the past couple of years in relation to inflation and interest rates and what is likely to take place next. This article focuses on what all this means for savings and investments. In addition, it will address a key question that was asked of me several times last year – when interest rates are so high and it is possible to obtain a healthy risk-free return, why invest in the roller-coaster that is the financial markets?

Risk & Return

By their very nature, there is always some risk when investing in the financial markets, although it is possible to calibrate a portfolio by the level of risk acceptable to the client. However, over the long term, the risk of your cash diminishing in value is much higher if you leave it in the bank. Certainly, over shorter-term periods the markets can be volatile and at any one point it is possible that the value of your investment will be worth less than the initial value of your premium. This never feels like a good place.

This leads to the question, why take any risk now, when it is possible to benefit from a return of between 3-6% by leaving your money in the bank? Well, in the short term, that’s a reasonable point and especially if your risk profile is low – i.e. you prefer not to take risks with your money, even knowing that this approach is likely to result in a lower return on your funds – then certainly a case can be made for this, at least in the short term.

French Interest-Paying Bank Accounts

In France, the best risk-free returns are to be had utilising the Livret A (maximum deposit of €22,950) and Livret de Développement Durable et Solidaire (LDDS) accounts (maximum deposit of €12,000) which are both paying 3% interest currently, free of tax and social charges. It makes a great deal of sense to place funds in these accounts as they are instant access, and it is important to have funds that you can access easily.

For those on lower incomes, 5% interest can be obtained with a Livret d’Epargne Populaire (LEP), with the maximum amount that can be deposited being €10,000. You will need to provide a copy of last year’s tax return documents (the Avis) to demonstrate that your income level is below the required threshold. Currently this threshold is €22,419 for a one-part and €34,393 for a two-part household – further details in this link https://www.service-public.fr/particuliers/vosdroits/F2367

For those with more significant amounts of funds and/or whose risk profile is higher, these accounts are still well worth using for holding an emergency fund that is easy to access.

For those with bank accounts in the UK, the returns have been even higher, and it has been possible to obtain 5% or even 6% interest, which is certainly appealing.

Risks of Keeping Assets in Cash

However, there is a but – or several buts in fact:

a) If your cash is earning significantly more than 3% (the LEP excepted), the chances are that your funds are in a UK bank account (not French), and you will have to pay tax on this interest in France. Therefore, whatever rate of return you are receiving in the UK, needs to be reduced by nearly one third to arrive at an actual net return.

b) All market commentators believe we are now at peak interest rates – in both the UK and Eurozone – and the next move will be down. Bank rates have been at levels hitherto unseen in decades, but they will surely not remain at this level as we progress through 2024.

c) Benefiting from high interest rates can easily coincide with periods of strong financial market performance – i.e. whilst you are benefitting from one, you could be missing out on the other!

d) Investing in the financial markets has always provided a greater return than cash over the long term.

e) Returns from cash have always failed to keep up with inflation over the long-term.

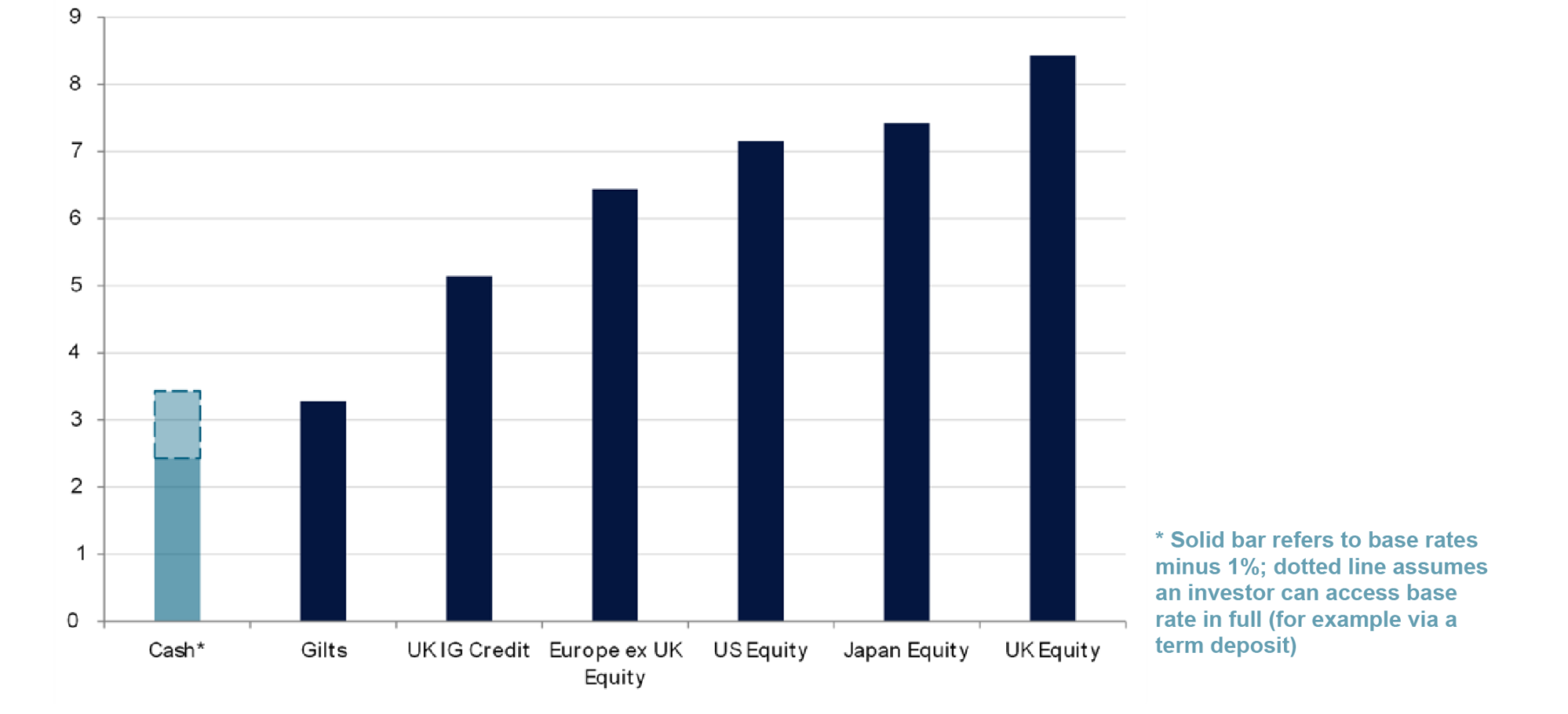

f) Rathbones, one of the UK’s leading investment managers, has forecasted that equities will return significantly more than cash over the forthcoming decade, see below:

We forecast that equities will return much more than cash over the next decade too

Rahtbones’ 10-year annualised % total return projections in GBP

Sources: Refinitiv, Rathbones Our projections were last updated in Q1 2023

Investments can go down as well as up and you could get back less than you invested. Past performance is not a reliable indicator of future results.

One of the best, short articles I have read in relation to the risks of keeping most or all your assets in cash is on Trustnet and quotes from Lindsay James, Investment Strategist at Quilter Investors. I enclose the link to the article below.

Sitting in cash ‘isn’t as risk free as investors think,’ warns Quilter | Trustnet

If you only look at the two graphs, this will illustrate the point clearly:

a) Graph No. 1: The first graph shows what happened to global financial markets in the year following the first interest rate cut (i.e. at the beginning of a rate cutting cycle). There are a few exceptions (most notably during the Global Financial Crisis in 2008/9), but in most cases the financial markets rose strongly. It is too late to wait until this happens and then move funds into the markets, as often the biggest returns can occur over the duration of just a few days, and this leads to the second graph.

b) Graph No. 2: This graph is even more stark, showing the investment returns over a 30-year period of an initial investment of £10,000. Staying invested throughout this period resulted in growth of 1020%. Being absent from the markets for just ten of the best days in the financial markets during this 30-year period, result in a return of half this amount, 469%!

This is why within the world of investing the following saying is so popular – “it’s not about timing the market, but about time in the market” or to put it another way, research has shown that those who remain invested in the markets through the troughs as well as the peaks, generally outperform those who try and time their buy and sell decisions to exit the markets as they fall and buy into the markets as they rise.

The reasons for this are that inevitably, people sell too late (i.e. the markets have already fallen which triggers their decision to exit), and then are too late with their entry back into the markets and miss out on significant gains. Even amongst professionals, it is usually luck not skill (or the benefit of hindsight!) which allows people to call the top or the bottom of the market or get remotely close.

In Summary

Those with limited savings and assets, who cannot afford to lock funds away for several years, should utilise the French interest-paying bank accounts I referred to earlier. Those who are very risk averse and find the prospect of seeing their investments fall in value, stressful and anxiety inducing, should also find the best return they can using risk-free savings accounts, but should also be aware that over the longer term, their savings will inevitably underperform market returns.

However, for everyone else, the evidence clearly demonstrates that investing in the financial markets, irrespective of potential economic or geo-political challenges and even with the current appeal of interest on cash deposits, will, almost without exception, deliver positive long-term financial rewards.

At the risk of oversimplifying – my advice to most people is to set aside sufficient cash for short term needs and unexpected contingencies and invest the rest in a portfolio that is appropriate to your risk profile.

Where should you consider investing any funds? That is for my next article where I will review the best options in France for tax efficient investing.

The Value of Seeking Financial Advice

By Peter Brooke

This article is published on: 26th March 2024

My name is Peter, and I am a financial adviser!

There, I have said it, and I can own it!

The personal financial advice industry has often been regarded as a home for insurance salesmen in shiny suits or as an out-of-reach luxury for the very wealthy. It hasn’t helped with various mis-selling scandals over the years and high levels of hidden fees, but after 25 years in this industry I wanted to make the case as to why we are not all the same and show what true value can be taken from seeking professional advice.

Fortunately, our industry has changed a lot over those 25 years and transparency, communication and ‘putting the client first’ have now become the values most of us live and work by.

As a little background, I wanted to be a Vet or a Doctor when I was at school, I loved science and maths but didn’t truly focus enough on my A-Levels and was found wanting when it came to getting into Medical School. I ended up studying Molecular Genetics at Sussex University but discovered that I also didn’t want a life in a lab. As a ‘frustrated Doctor’ I ended up in Pharmaceutical Sales… great fun as a young man straight out of Uni but it became a very demoralising job and one which I discovered was really all about making money, not helping people.

I was encouraged by a family friend to look at stockbroking or financial planning as a change of track and started work in 1999 (dot com!!) at an investment advisory business in London. We introduced the UK’s first ‘advisory-discount’ services where we would provide personalised investment recommendations at discounted fees.

Ironically, it took moving to an industry that concentrates solely on money to realise that I could actually help people achieve wellbeing and peace of mind through my abilities to discuss and explain complex issues.

In 2004 I moved to France and started working with The Spectrum IFA Group, helping English speaking expatriates to create and realise their plans for living in France, I have been here ever since. I especially wanted to join a fully regulated company which gave me the independence of my own business and together we have grown to where we are today – 50 advisers operating across Europe, in France, Spain, Portugal, Italy, Luxembourg, Malta and Switzerland.

What should we, as financial advisers, aim to provide to our clients?

I believe our true value lies in helping our clients answer two main questions:

1. Am I going to be ok, financially, and if not, what do I need to do to make sure I am?

2. What have you, as my adviser, done for me?

The first question is the core of a good adviser’s skill set and business strategy – it is all about helping identify and plan for different stages of life. Correctly laying out a ‘roadmap’ for the future and asking the difficult questions; this can truly provide the peace of mind that you, as my client, are on target, and if not what do we need to change or compromise on to ensure you get there.

This roadmap then needs ongoing reviews, especially as life throws various obstacles at us along the way.

The second question is the ‘HOW’ of the first question. Historically we have valued good advice, and what we pay for it, as a percentage measurement of investment performance, which the adviser actually has minimal control over.

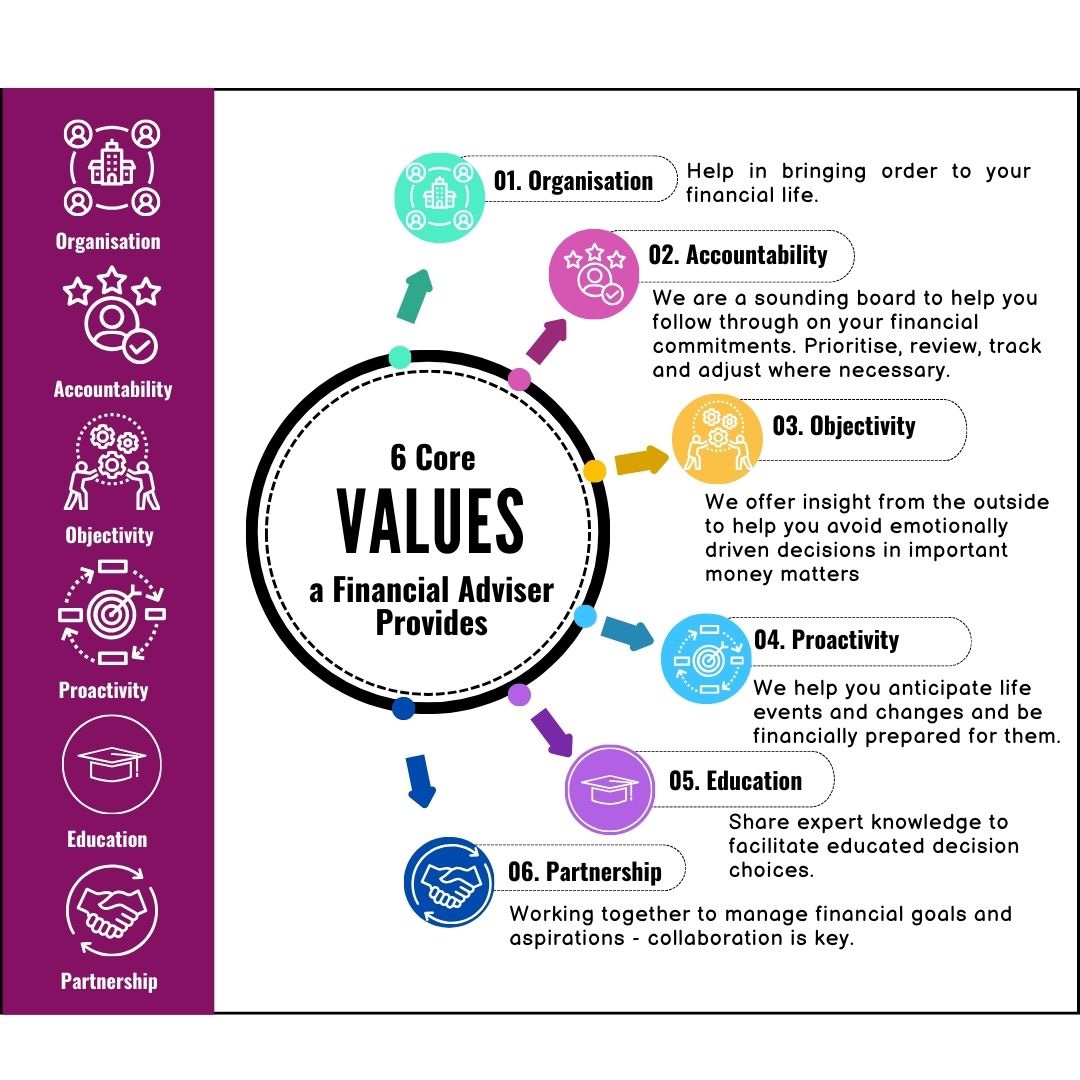

I believe it is more nuanced than this and can be broken down to six key areas in which we can (and should) add value and help answer that first very important question:

We help to bring order to your financial life by assisting setting budgets and cash flow targets as well as overseeing and reviewing investments, insurance, estate plans, taxes, etc.

We are a sounding board to help you follow through on your financial commitments, by identifying and prioritising goals, and then explaining, in plain english, the steps to take, and then regularly reviewing your progress towards them.

We offer insight from the outside to help you avoid emotionally driven decisions in important money matters; we are available to consult with you at key moments of decision-making, providing the necessary research to ensure you have all the information to make the best choices.

We help you anticipate life events and changes and be financially and emotionally prepared for them. We can help in creating, ahead of time, the action plan necessary to address and manage any life transitions that inevitably appear.

We explore what specific knowledge will be needed to succeed in your plans by understanding your situation and then providing the necessary resources to facilitate your decisions, and explaining the options and risks associated with each choice in a clear and simple manner.

We aim to help you achieve the best life possible but will work with you, not just for you, to make this possible. We will take the time to clearly understand your background, philosophy, needs and aspirations and will work collaboratively with you and on your behalf (with your permission, of course).

Upfront about what it costs

For me, helping people is at the centre of my personal values – being paid to do this is a welcome bonus and I have long believed that our jobs find us, not the other way round. I have always been a bit of a ‘planner’ and see ‘the big picture’ in most situations – helping people see that ‘they are going to be ok’, or explaining ‘what they need to do to get there’ is a truly pleasurable challenge for me.

Price is what you pay, Value’s what you get

I firmly believe my clients get value for money. In Europe we are not regulated to handle client money so will never send you a bill for you to pay us directly.

Spectrum is remunerated by the insurance or investment company which provide the final financial solution to you and with whom you have a direct relationship, with us ‘appointed’ as your adviser.

I believe in transparency of all costs and charges so you know exactly what you are paying and to whom. Our charges are competitive, we only use clean share classes of funds so there are no hidden or double fees.

Making the time – ‘How can I help?’

I live and work in a community of English speaking expatiates where referrals and recommendations count for a great deal. I always feel very proud and grateful when an existing client refers me to another family member or friend who might be able to benefit from the services that I offer. So thank you for trusting me with them and I look forward to helping more in the future.

Snapshot of our services

- Financial Planning & Budgeting

- Family protection

- Cash Flow Planning

- Investment Management Advice/Guidance

- Tax optimisation through tax efficient products

- Estate & Inheritance planning

- Risk Management, diversification & asset allocation

- Retirement planning

- Education cost planning

- Long term care planning

- Pension advice including transfer and consolidation

If you know someone who might need our services, feel free to get in touch and forward them this email – the link above can be used to book a 30 minute call with me directly. If I can’t help then I may be able to direct them to someone who can.

If you have any questions or would like a catch up then please use any of the below communication channels or the booking system – always drop me a quick message if you need a time slot outside of those available.

For existing clients the CashCalc secure portal is a great place to update any information, send me documents or even a direct secure message.

If you have missed any previous emails, click here to access the Archive.

Buying you dream home in France

By Amanda Johnson

This article is published on: 20th March 2024

LIVE WEBINAR

TUESDAY 26TH MARCH

7pm – 8pm

We have a highly experienced team of panelists who will discuss all things to do with buying in and relocating to France.

I have worked with many of the panelists for a number of years and their knowledge and experience is valuable to me and my clients; so if you are looking at buying and/or relocating to France then please join us for this live webinar

Our experienced panelists are here to discuss all nature of topics to do with buying and relocating to France:

Karen Tait – Webinar host

Amanda Johnson – Wealth & tax expert from The Spectrum IF Group

Joanna Leggett – French Property Expert from Leggett

Jonathan Watson – Currency Expert from Lumon

Paulette Booth – Banking and insurance expert from AXA

Tracy Leonetti – Visa & paperwork expert from LBS

Sharon Revol – Mortgage expert from Cafpi

Interest Rates – what next?

By Philip Oxley

This article is published on: 11th March 2024

What has happened, why, and what next.

Writing this at the beginning of 2024, interest rates around much of the developed world are higher than we have known for many years, in fact for decades.

This is the first part of this article on the subject, where I will look back at events over the past couple of years and what we can expect to happen next. The second part of the article will focus on what this all means in relation to the world of savings and investments, particularly when interest rates are higher than we have seen for decades.

Overview

Without delving too deeply into the world of macroeconomics, I think it is helpful to provide a brief overview of what has happened over the past couple of years in relation to inflation and interest rates and why. I will then look forward to what can we expect to take place over the next 6-12 months.

a) Interest rates – what has happened and why?

Central Bank Rate

In the UK, the Bank of England base interest rate is 5.25%. In the US, the Federal Reserve increased rates at a speed rarely seen before and rates are currently 5.5%. Finally in the Eurozone, the European Central Bank (ECB) rate, which is applicable in France, is 4.5%.

Outside of these areas, rates have increased in many other countries around the world (Japan is the notable exception, for now). In China rates are currently 3.45%, in India 6.5%, Russia 16% and Türkiye 45%.

Why have interest rates increased?

In a word, inflation. UK’s inflation rate peaked last year at 11.1% and you need to go back to the 1980’s to find a time when inflation reached higher levels. In France, inflation peaked at 6.3% last year and in the US at 9.1%, and again these rates were last reached in both countries back in the 1980s.

Who is responsible for controlling inflation?

It is the primary mandate of both the Bank of England’s Monetary Policy Committee (MPC) in the UK and the Eurozone’s ECB’s monetary policy to maintain price stability. For the MPC it is to “set monetary policy to achieve the Government’s target of keeping inflation at 2%” and the ECB it is “by aiming for 2% inflation over the medium term”. The equivalent body in the US is the Federal Reserve and interestingly, they have a dual mandate, which is to “achieve maximum employment and keep prices stable.”

I do not think it is too controversial to state that all three have failed to some extent in their primary objective over the past 18 months. Although in the US, employment levels have remained impressively high, so we should give the US Federal Reserve some credit for that.

How do you reduce inflation?

There are various tools and theories in relation to the control of inflation, including controlling the money supply (from where the phrase “monetarism”, commonly used during Mrs Thatcher’s time in power comes), Quantitative Tightening (QT) which is essentially rolling back and reversing years of Quantitative Easing (QE) that the central banks employed both after the Global Financial Crisis in 2008/9 and again during the Covid pandemic to boost economies. However, the primary tool used by all central banks is interest rates.

How do interest rates reduce inflation?

Higher interest rates suck money out of the economy, dampening spending, and loans. For consumers, mortgages, loans, and credit cards cost more, leaving less money to spend, resulting in lowering demand and inhibiting price rises. In addition, people are encouraged not to spend but to save, as it becomes easier to obtain a return on savings. Again, this adds to the reduction in consumer spending and businesses need to respond by either cutting prices or reducing the level of increases thus facilitating lower inflation.

Usually, a period of increasing interest rates is followed by increasing unemployment as businesses struggling under higher costs and lower sales must find ways to cut costs (and for many businesses, labour costs are a sizeable proportion of their cost base). This increase in unemployment can have a dampening effect on wage increases (people are prepared to accept a job offer at a lower rate than hitherto before), again all feeding into a deflationary cycle. I say usually, because employment levels have remained impressively robust in the US, UK, and the Eurozone.

b) Interest rates – what next.

Current interest rates

It is always a foolhardy exercise to try and predict events in the financial markets, but there are enough signals now, that some events appear to be inevitable (although I am keeping my fingers crossed that I do not regret writing this!)

In the US, the last interest rate increase by the Federal Reserve was in July 2023, in the UK the last increase of interest rates, to 5.25%, was in August 2023 and the ECB’s last rate increase was last September. Those rates have remained at that level ever since.

Last year market analysts starting using phrases like “higher for longer” and that rates would follow the profile of Table Mountain (a flat-topped mountain in South Africa if you are not familiar with it) in their assessment of what would happen to interest rates in the future. Another way of saying that once rates hit their peak, they would stay at that level for some time – and this has proven to be true.

What next for interest rates

Market analysts are strongly predicting that 2024 will be a year when interest rates start to decline. The only aspect of this prediction that seems uncertain is when the cuts will begin. The consensus is from Spring/early Summer with the ECB and/or Federal Reserve perhaps being the first to start the cycle of rate cutting.

Why in this important?

All the central banks are treading a fine line – trying to balance on one hand, calibrating interest rates to ensure the elimination of high inflation and bring levels back to around 2% sustainably. On the other hand, if they keep rates high for too long, they risk pushing their economies into recession. It is too late for the Central Bank of England, as the UK is already technically in recession (two successive quarters of negative GDP growth), as is Japan. The Eurozone is also perilously close to recession, but it is currently believed that the US is likely to avoid recession.

It is also important because high interest rates impact businesses as well as consumers and typically the financial markets have responded positively to the start of a rate cutting cycle which among other items, will be discussed in the second part of this article.

Financial update France March 2024

By Katriona Murray-Platon

This article is published on: 6th March 2024

For me it always feels like January is such a long month, February passes in a blink of an eye and all of a sudden it’s March and there is so much excitement and activity. I had a few days off at the end of February to spend time with my boys, rest and recuperate and catch up on some reading.

One of the things I like to read is the Le Particulier magazine and this month they had a very interesting special limited edition on how and where to invest in 2024. There was a lot of information in this special edition which I found fascinating but also a lot that confirmed many things I had been advising for a while.

One key point is that whilst having savings accounts such as the Livret A, the LDDS and (if you are eligible) the LEP are great places to keep your money in the short to medium term, by which we mean in the next 5 years, these accounts should only be used as emergency funds or money destined for a particular project that you intend to carry out soon. This is why on the Spectrum Confidential Review document we ask our clients which bank accounts they have, what the interest rate is on them and what is the purpose of this money. If there isn’t a reason to have these savings and you can’t foresee a reason for using the funds within the next five years, then it is important to think about investing some of it as, no matter what the rate currently offered, such rates will not protect your money from inflation over the long term.

I’m often asked about how to save money for children. If you have a child aged between 12 and 25 years of age you can open a Livret Jeune in addition to them having a Livret A. Your children who are included in your tax return cannot have a LDDS as these are only for tax payers. However the Livret Jeune can have a maximum capital of €1600 and whilst the interest rate is not fixed by the Banque de France, banks are required to set an interest rate which is at least the equivalent of the Livret A but may also play the competition and offer more.

In the longer term it is important to invest and the preferred way of doing that in France is by using an assurance vie. According to a statistic in this special edition of the Le Particulier magazine, over a period of 20 years the Livret A account had only made 40% compared to a CAC 40, with dividends reinvested, managed fund with a 3% management fee, over the same period made 289%.

March is a month where things start to happen. I read recently that mortgage rates have begun to fall in France. Although the ECB decided on 25th January to keep the key three interest rates unchanged, there is a strong expectation that mortgage rates will continue to fall this year possibly reaching 3.5% this summer and as low as 3% by the end of the year. This will be much welcome news for those looking to sell property in France.

From 1st April you won’t need to fiddle around to try and put the little green insurance certificate square on your windshield. If you are stopped by the police during a routine insurance check they will be able to tell whether you are up to date with your insurance by checking your license plate with their database.

For those invested with the Pru, there was good news this month as on Monday 26th February 2024 the Prudential Assurance Company (PAC) board reviewed the Prufund Expected Growth Rates (EGR) as part of the quarterly review process and once again there were no unit price adjustments. The expected growth rates remained the same for the PruFund GBP Growth and Cautious funds, whereas for the PruFund Growth Euro fund the Expected Growth rate was lowered slightly to 6.6% (previously 6.9% in November) and the PruFund Cautious Euro to 5.7% (previously 6.2% in November).

Although the tax season in France doesn’t begin until April, I know that lots of you will be thinking about preparing your tax returns. If you have any questions on your taxes or any other financial matters please do get in touch.

The view from the Danube

By Peter Brooke

This article is published on: 4th February 2024

2024 marks my 20th year as a financial adviser at The Spectrum IFA Group and I am lucky to have been invited to every one of our annual conferences since I joined in June 2004. Last week more than 40 members of the Spectrum family got together in the beautiful Hungarian city of Budapest for our latest conference.

We are always delighted and grateful to welcome excellent external speakers from some of the big investment and insurance firms we work with throughout the year who share their wisdom (and/or best guesses) for the months and years ahead; it was therefore an ideal time for me to pick brains over some goulash and a glass of wine and bring you some considered observations for investing in 2024.

But before looking forward, let’s look at how we got here.

2022 was a very tough year for investors with the hangover from the Covid pandemic and the war in Ukraine creating a perfect inflation storm which led to the most aggressive interest rate hiking cycle in over 40 years. This significantly depressed bond and share values.

Through 2023 there were four distinct periods of rhetoric and market behaviour… it started with the Artificial Intelligence (AI) “revolution” and a huge rally in the “Magnificent 7” stocks in the US, then attention turned to likely recession… but was it going to be a “soft or hard landing” and then a considered period of ‘is this the end of inflation?’ followed by a change in attitudes to try and guess when the first interest rate cuts would start… we even ended the year with a ‘Santa Rally’ in global stock markets…. confusing times!

“Anyone who isn’t confused really doesn’t understand what’s going on!”

- In 2024 nearly half of the global population will be going to the polls; will this influence investments?

- Can we avoid a recession, and if not, what will it look like?

- Will interest rates be cut and if so, what does this mean?

- Is AI really going to change the world?

Most of the investment managers we spoke to last week had the same view on these sorts of questions…

Politics rarely has a material long term effect on investment returns but can create short term uncertainty and opportunities – be active and don’t get caught up in the hype!

Recession

- Soft Landing = inflation comes down and economic growth is moderate – the ‘Goldilocks’ scenario

- Hard Landing = inflation comes down but the economy shrinks – leads to higher unemployment, default on debt and lower consumption

The consensus view is that we will probably avoid a hard recession, especially in the US, which is still the most important economy on the planet. US households still have high levels of savings and long-term debt structures, so aren’t too affected by higher short term interest rates; unemployment remains low and the ‘Inflation Reduction Act’ is still pumping money into the economy.

However, there is a case for a hard landing with some indicators predicting one, but we live in a world of probability and not certainty and this is changing constantly.

“Don’t be too pessimistic but remain cautious … and don’t be too optimistic… anyone still confused?”

We are at the end of the inflation cycle now and so interest rates are likely to start being cut in May (US) and June (Europe). This will be good for bond values, so don’t sell them now.

Artificial Intelligence will destroy some businesses and will make some very profitable. “It’s like internet 2.0”. It is also unlikely to be the companies that ‘started’ the AI revolution which will do best from it… it will be the companies who best embrace it and who create the infrastructure for it, that will profit most.

Demographics – nothing has changed – there are more of us than ever and we are living longer… and the Obesity epidemic is not cured by one or two weight loss drugs, there is a long way to go.

Retreat from globalisation

“Protectionism”/“MAGA”. We are not going back to globalisation and is it a coincidence that geopolitical instability has also increased? The world is a more dangerous place – we must consider greater Geopolitical risk.

So, with all these factors to consider how do we invest for 2024?

Retreat from globalisation = Defence companies and Oil producers, this might not sit well with all investors.

- AI = hardware, chip makers, nano technology, semiconductors

- Demographics = MedTech – improved prevention and treatment efficiency as opposed to just buying more drugs

- Hard Recession = own government bonds! Also own high quality equities – be active

- Soft or No Recession = own equities – but avoid those with high debt – be active

Even with all of the confusing narrative there are some reasons to be positive in 2024:

- Geopolitics will remain the same, protectionism will continue

- Interest rates are moving back to ‘normal’

- Strong labour market

- Housing set for recovery…. Falling interest rates

- Productivity growth from technology and AI – leads to greater profits

- Markets go up 70% of the time

“Look through the hype and stick to your own personal investment commitments and goals … oh… and employ an active manager!!”

I would very much like to thank the investment management teams at RBC Brewin Dolphin, Rathbones Investment Management, Evelyn Partners, New Horizons and The Prudential for their time and expert views on the content in this email.

If you would like to dive deeper into these subjects please check out the following links:

5 Investment themes for 2024: from Evelyn Partners

Some predictions for the year ahead from David Coombs at Rathbones

If you like podcasts then I highly recommend David Coombs amusing and insightful monthly Sharpe End Podcast

Feel free to get in touch if you have any questions via the below channels, or the booking system – always drop me a quick message if you need a time slot outside of those available.

If you have missed any previous emails, click here to access the Archive.

For now, have a great day, speak soon…

Financial Update France January 2024

By Katriona Murray-Platon

This article is published on: 8th January 2024

The new year is a great time for setting goals and making resolutions. I read that, according to a recent survey, saving money was the most popular resolution (after losing weight)!

Saving money is a very important habit to have throughout your life. The great thing is that it is never too late or early to start saving and you don’t need to put aside a lot. Just like it is not a good idea to do fad diets but more to make manageable improvements to your lifestyle, it is better not to make too ambitious savings plans but to put aside small regular amounts that build up over time.

The French standard savings accounts are currently earning 3% which will remain as such until the beginning of 2025. You are allowed to put €22,950 of capital into a Livret A and €12,000 into a LDDS. Once you have reached these limits you cannot put any more into it but the interest compounded over the years can be added to these amounts. The LEP is the highest remunerated savings account, currently at 6%, however if you are eligible for this account you should take advantage of this rate as soon as you can as it may drop to 4.2% on 1st February. If you are eligible you can have 2 LEP accounts per household and can put up to €10,000 of capital into it. To be eligible one person alone must not have earned more than €21,393 in 2022 as declared in 2023. Your bank will not automatically suggest that you open this account so it is for you to check whether you are eligible and request to open a LEP. There are other savings accounts and term accounts that the banks may offer but the rates on these are around 3% and unlike the above mentioned accounts, they will be subject to tax and social charges.

Whilst we don’t know how the market will react to various events and political developments in 2024, fixed income assets could continue to provide good earnings this year. Our investment providers have seen good steady returns in 2023 in their more cautious funds. Whilst savings and fixed interest assets are good to have, it is also important to have some equity based investments. According to a Credit Suisse study published in February 2023, the actual annualised return (after inflation) on the savings accounts in France was -0.8% per year between 1923 and 2022, compared with +6.1% from shares.

On the 15th January, if you have had home help expenses (cleaner, gardener etc) you will get 60% of this tax credit paid to you. The remainder will be taken off your taxes in September.

I will be attending our annual conference in Budapest from 22nd to 26th of January and will have lots of information to pass onto you when I hear the presentations from our product providers. Also coming in my February Ezine will be the news from the adopted French Finance law for 2024.

It is never too late or too early to financial planning so do get in touch and recommend your friends to get in touch with me for a free financial consultation.

Happy New Year 2054

By Richard McCreery

This article is published on: 4th January 2024

A tongue in cheek look at the world

three decades from now

The year is 2054. The Trump family presidency is about to enter its fourth decade of ruling power, with Ivanka in charge ever since her father abolished the 22nd amendment of the US constitution that limits anyone to two terms.

Today, the government has a 99% approval rating, according to the state-sponsored broadcaster Fox News, and the Trump family continue to win each election in a landslide, having introduced new rules to make the voting system fair and honest following the collapse of the Biden regime.

However, America is not the technological superpower it once was, having stubbornly doubled down on the use of oil, coal and gas whilst the rest of the modern world switched to clean, abundant renewable energy and electric cars. The technology-hating president Donald Trump eventually decided that the Big Tech billionaires such as Bezos, Zuckerberg and Musk were getting too big for their boots and nationalised their companies, declaring that it was his duty to the people to use his talent for business to run them himself. This move ushered in a new kind of capitalism as their huge profits were directed to fund the collapsing social security system, the construction of border walls sealing off America from Canada and Mexico, and enabling the Trump White House to install gold-plated toilets in every room, making it the envy of African dictators and footballers wives.

The US national debt has climbed to $340 trillion, a tenfold increase since The Donald regained power in 2024, but the Fed has kept interest rates at zero for most of the past three decades. The US Treasury has been able to fund the debt by creating a series of $1 trillion digital coins and by selling NFT trading cards. As a result, the ‘Trump’, the new name for the US Dollar, is one of the weakest currencies in the world – you currently get 250 Trumps to the Euro. The Trump administration has managed to stave off financial collapse by regularly threatening to ‘renegotiate’ America’s sovereign debt with its creditors, a scenario that everyone wants to avoid.

Whilst America has begun to resemble a strange version of Cuba or North Korea, Europe has enjoyed a surprising renaissance, thanks to its early adoption of artificial intelligence as a key element of government. For once, the hype turned out to be real (albeit 15 years after the first AI stock market bubble had popped) and AI advanced rapidly as it was entrusted to take over from politicians. A new law in 2035 stating that anyone who expressed a desire to go into politics would immediately be banned from going into politics meant that a new way to govern had to be found. By harnessing AI for the common good, rather than allowing it to be controlled by a few large companies or rich individuals, Europe has been able to rebuild its infrastructure, increase the leisure time of its working population with the introduction of the 3-day week and overtake the US and Asia in the development of new virtual reality worlds where most retired people now spend their final years – it has become possible to see the world, live out your dreams and fulfil your fantasies, all without leaving the comfort of your armchair.

Norway has become the most admired nation in the world, an example of good resource management and social equality. It’s oil fields were eventually depleted but, unlike other oil-rich nations like Saudi Arabia and Russia, Norway had invested its wealth for future generations into thousands of companies around the world. As the only country to have virtually no debt, Norway’s Krone has since taken the place of the US Dollar as the world’s reserve currency.

The Krone has gold-like limited supply, is backed by real wealth and an economy powered by an abundance of clean thermal and hydro electricity. In 2031, Norway became the first country in the world to have an all-electric transport system, having waved goodbye to petrol engines long before anyone else. It’s cooler climate has also made it one of the world’s most popular holiday destinations now that parts of the Mediterranean region have become too hot to support life outdoors during the summer months.

Technological advances in the early 2040’s mean that global poverty, water shortages and hunger around the world may soon become a thing of the past. The spread of AI-powered nanobots throughout industry and agriculture has increased productivity by thousands of degrees of efficiency. No longer is output restricted by physical human strength, labour laws, poor education, the need for holidays or sick leave. Tiny machines that are able to reproduce as the work requires are now populating factories and fields in vast numbers, freeing humans from the slavery of the daily struggle to feed themselves or earn a living. This new workforce has massively increased our efficiency when using finite natural resources, it has created a recycling movement that ensures nothing is wasted and has generated an abundance of goods and services.

Education is now available to anyone who is connected to the world wide web, which these days is everyone. Society’s best teachers no longer stand in a lecture hall in Cambridge or Harvard, educating only a few privileged students. Today, they are treated like rock stars as they broadcast their lessons around the world to millions of people at a time, giving students everywhere the chance to be taught by the best in their field. However, despite a leap in global education levels, AI has not been able to come up with a way to genetically eliminate stupidity, even if it is now recognised as a medical condition for insurance purposes.

Instead, advanced neuroscience technology, first brought to the mass market by Elon Musk, allows a person to switch between their original brain and a Tesla artificial brain that is installed alongside. The new technology is prone to make mistakes and somewhat fails to live up to the hype but it is very popular thanks to its ability to allow the user to function in ‘self driving’ mode and switch off their real brain.

War has largely been eliminated in 2054. The spread of the internet to every part of the globe helped people of all nations and religions to bond and empathise with each other. For the first time in history, people were able to see and really understand how other people lived. They might not all agree with each other but the urge to kill has been reduced dramatically (except in America) and the need to occupy more territory has been negated by expansion into new digital universes and, soon, into space. The end of corruption in politics also meant that the world’s largest arms companies suddenly found themselves facing a demand shortage as government budgets were directed elsewhere, so they naturally directed their skills towards space exploration.

War isn’t the only thing that has been eliminated – so has smoking, alcohol, red meat, close human contact (unless you have a license), telling off children, boxing, speeding, fast food and swearing. The proliferation of cameras everywhere ensures the population remains polite and well behaved, much like Japan. Only the Clarksonites remain in defiance, an underground movement dedicated to preserving what they describe as the lost arts of fun, debauchery and common sense.

However, despite the relative sanitisation of humanity, in the year 2054 the future is looking bright. The stock market is up, house prices are up and most people around the world have food on the table and more tv programmes than they can ever watch. The depression years of the late 2020s, a hangover from the locked-down COVID era, have given way to a time of greater optimism, more peaceful co-existence and rising prosperity. Climate change has been arrested thanks to clean-tech, space travel is opening up new frontiers in human exploration and the virtual reality worlds are enabling new lives in the digital universe. It may not be perfect, but it is a lot better than anything the science fiction writers of the late 20th century were predicting.